(Bloomberg) -- For Lovelace—who, unlike his father and grandfather, is vice chairman instead of chairman—this challenge is bigger than Capital Group. It’s about his family’s faith that research and reason can help investors beat the overall market.

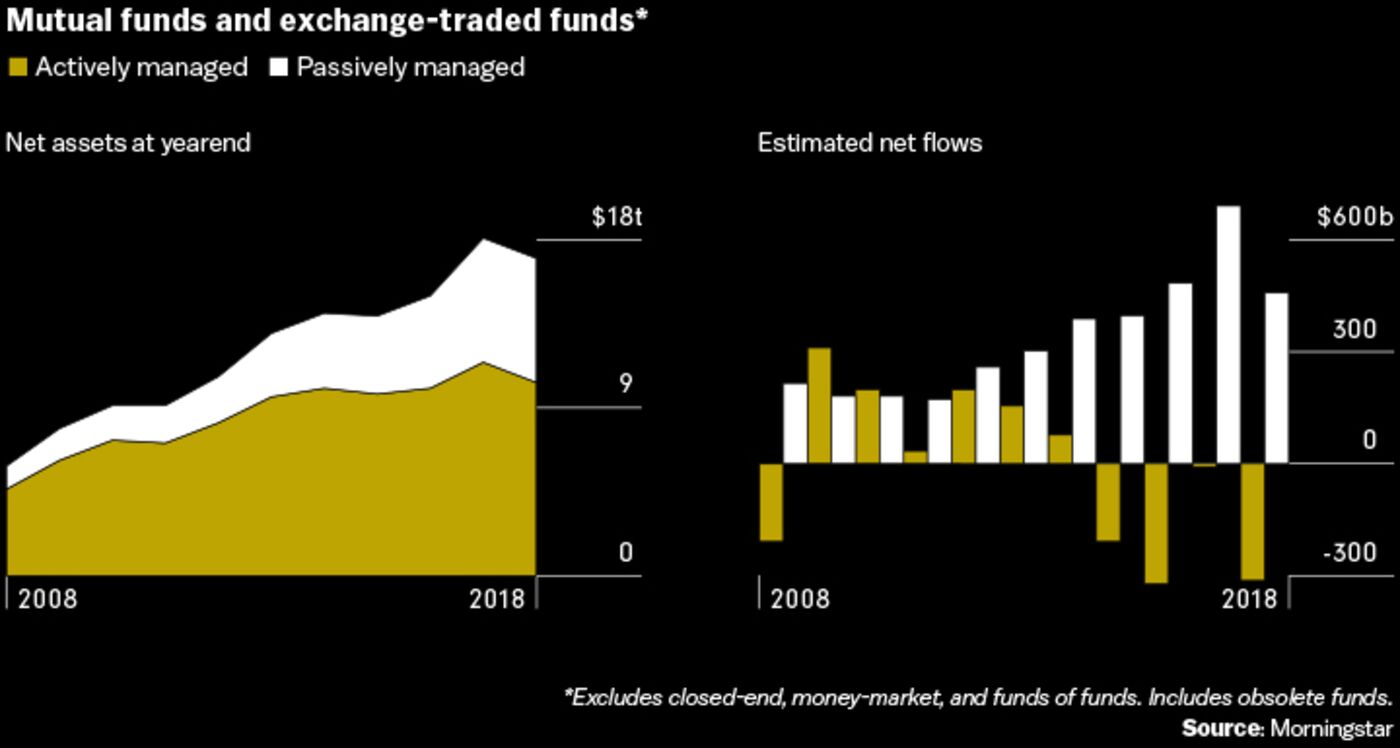

That conviction has been at the root of the company, best known for its American Funds family, for almost 90 years. But now, more than ever, active management is being dismissed by the investing public.

Vanguard Group and BlackRock have vacuumed up market share with funds that mimic broad market indexes for a fraction of the cost of Capital Group’s funds.

In some respects, Lovelace is resigned to the trend toward such low-cost, passive investing. “We don’t fight passive,” he says. “It’s OK. We just know what we do is even better.”

That contrarian streak can be traced back to Lovelace’s grandfather. Jonathan Bell Lovelace, known as JBL, was a math whiz who grew up in Alabama and moved to Detroit after World War I to join an army buddy’s brokerage. In September 1929, alarmed by the gap he saw between companies’ fundamental values and their stock prices, he cashed out most of his holdings in the market and the firm. He was on a California-bound train when the stock market crashed on Black Tuesday.

In Los Angeles he started Capital Research and Management Co., recommending stocks for funds run by his struggling former firm in Detroit. In 1932, JBL took over as chairman of those funds, building Capital’s assets throughout the Great Depression.

“His somewhat heretical view at the time was you should actually know something about the companies in which you’re investing,” Rob Lovelace says. “It was always based on research. This was our comparative advantage. This is in our DNA.”

As Capital Group grew, JBL persuaded his son, Jon, to join and eventually lead the company. In the 1950s, after JBL suffered a heart attack that put him out of commission for years, Jon created a system to distribute fund-management responsibilities, reducing the company’s reliance on any single person.

“Everybody thought that was a cockeyed idea, including me,” said Jon, who died in 2011 at age 84, in a book published for the company’s 75th anniversary. “But it was good for the transition, at least, and that’s how it began. And it ended up working so well, we kept it!”

The Capital System works like this: Every fund has from 3 to 13 managers, each of whom oversees a distinct portfolio known as a “sleeve.” Within general parameters, such as market capitalization or bond ratings, managers are free to choose the securities they want. They’re encouraged to follow their strongest convictions. Those are informed by research that goes beyond analyzing company financial statements and meeting executives—last year Capital Group’s 320 investment professionals logged 12,400 visits to factories, warehouses, laboratories, and other sites.

An example is the $88.7 billion New Perspective Fund.

Facebook Inc. is the fund’s second-biggest holding. But Rob Lovelace, the longest-tenured co-manager, doesn’t own any Facebook among his sleeve’s 80 securities.

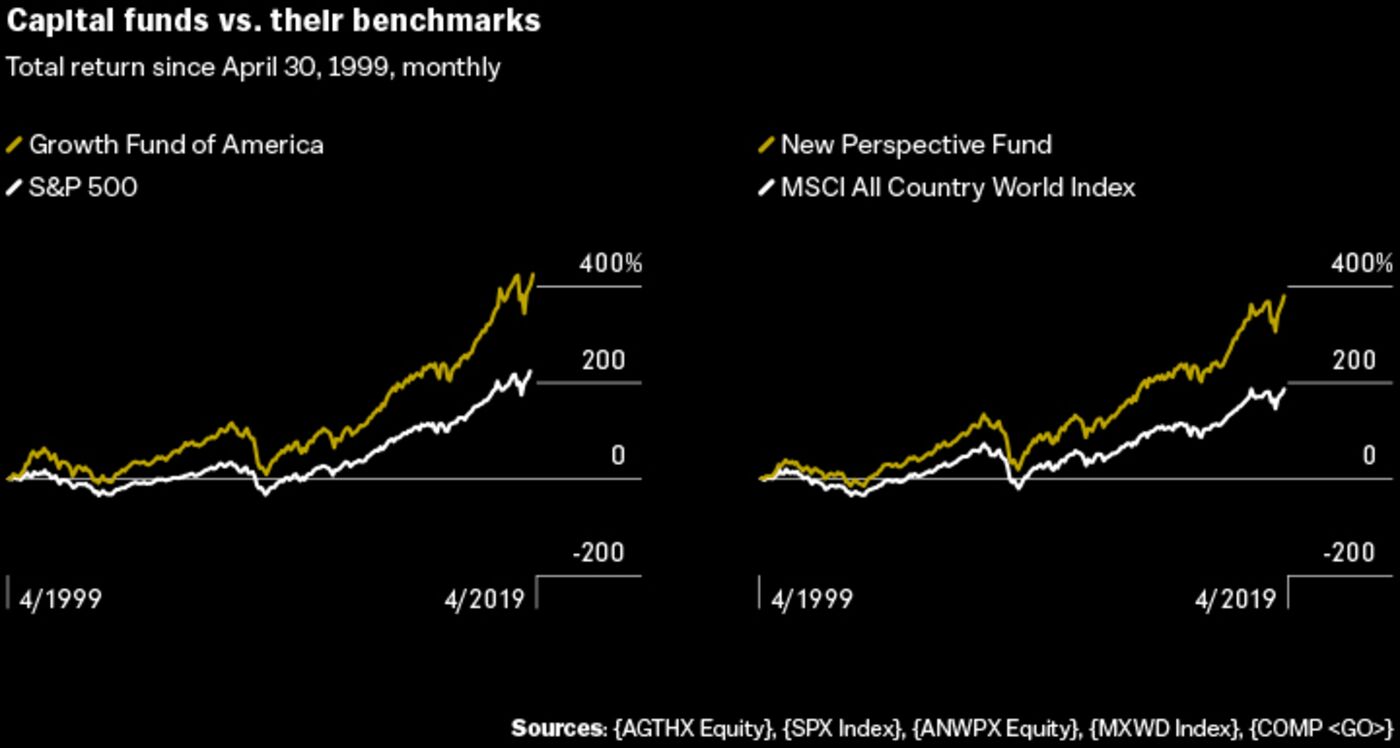

He prefers Amazon.com Inc. Net of fees, the fund has beaten its benchmark consistently over two decades.

Lovelace recalls visiting Capital Group’s offices as a boy, when managers used slide rules and adding machines to analyze balance sheets. He became interested in investing as a teenager and still owns shares of toymaker Hasbro Inc., the first stock he ever bought. Today, Capital Group is Hasbro’s largest shareholder, with an almost 15 percent stake. The stock returned an average of about 20 percent annually from the end of 1980 to the end of 2018, almost double the 11 percent average annual return for the S&P 500.

Until the financial crisis, American Funds outperformed competitors, losing less in bear markets and starting from a higher base in ensuing recoveries. It reeled in hundreds of billions of dollars after the dot-com bubble, vaulting to the top ranks of mutual fund families. Its Growth Fund of America became the world’s largest mutual fund.

As Capital Group thrived, a radical idea was starting to take hold. A growing body of academic research cast doubt on stock picking. Markets were so efficient that investors couldn’t beat them over the long term. Jack Bogle, a Princeton graduate like Jon and Rob Lovelace, though investors were being ripped off. In 1974 he founded Vanguard Group in Valley Forge, Pa. Two years later, Vanguard started selling a fund that simply held all the stocks in the S&P 500 index. It was the first retail index mutual fund.

Back in Los Angeles, in keeping with its generic name, the closely held Capital Group blended into the background. Then, as today, it sold its funds through intermediaries such as retirement fund consultants and financial advisers. The company logo doesn’t appear on its headquarters, which occupy 12 of the 55 floors in the Bank of America Plaza building.

The north-facing windows provide a view of the Hollywood sign, but Capital Group has no celebrity managers, and its executives keep a low profile. When James Rothenberg, chairman for almost a decade, died suddenly of a heart attack in 2015, it barely broke stride. “He was a fantastic leader,” says Gordon Crawford, the retired Capital Group portfolio manager who delivered the eulogy at Rothenberg’s funeral. “But you took out Jim and slotted somebody else in, and the funds didn’t get negatively impacted.”

Capital Group installed Tim Armour, now 58, to take over. Like many executives, he’s spent his entire career at the company, having joined after graduating from Middlebury College. He still manages part of the $21.7 billion New Economy Fund, which invests in large-capitalization stocks around the world. It’s returned about 11 percent annually over the past five years, beating 97 percent of its Bloomberg peer group.

Most Capital Group portfolio managers have at least $1 million of their own money in their funds. A group of analysts, including some recent recruits, manage a sleeve of about 20 percent of each fund, adding to the diversity of views feeding portfolios. Women made up almost 45 percent of new hires last year, though they’re still only 23 percent of the money managers and analysts. Compensation awards are heavily influenced by five- and eight-year records, promoting long-term performance. “It’s not possible to build a good record and coast,” says Alec Lucas, a Morningstar Inc. analyst who follows American Funds.

Owned by 450 partners, the company is secretive about its revenue and profitability. After Armour filed for divorce in 2003, it intervened to seal court records that revealed compensation or financial performance. The move surprised Armour, but he says it made sense for the company. “I think the organization did what it needed to do, trying to protect what’s very valuable to us.”

The company offers 36 stock, bond, and balanced mutual funds, a modest menu imposed to avoid confusing customers and to gain scale to keep fees low. It offers no exchange-traded funds, even though it received regulatory approval to do so in 2015. “Nothing seems to move particularly fast with Capital Group,” says Jonathan Nolan, an analyst with Francis Investment Counsel in Brookfield, Wisconsin. “They’re not concerned with any investment fads.”

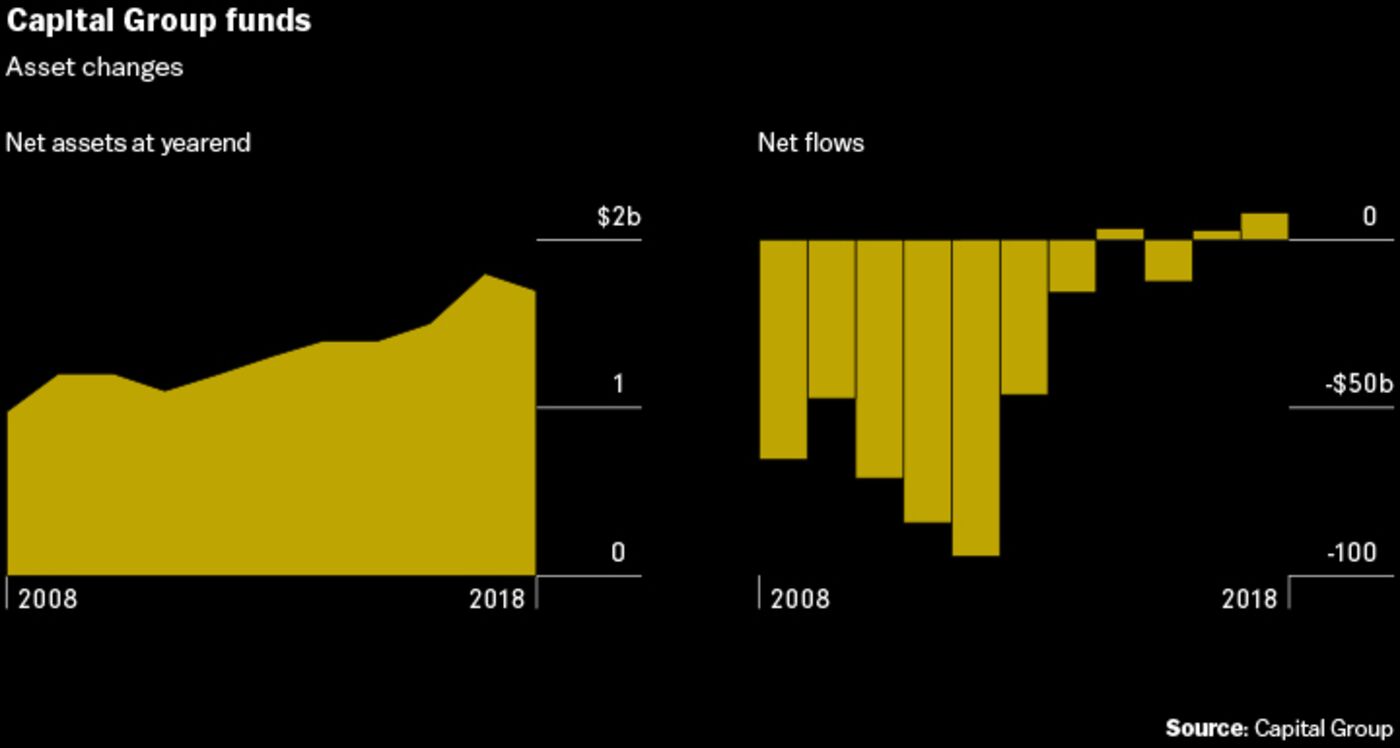

The financial crisis was a trauma that couldn’t be ignored. Assets under management plunged to $975 billion in 2008, from $1.6 trillion a year earlier. The firm cut 18 percent of its staff over the next three years. Vanguard overtook American Funds to become the biggest U.S. stock and bond fund manager, a position it still holds. Capital Group executives grappled with what to do. They concluded the problem wasn’t with the funds’ investing style. Instead, they decided they had to fix their relationship with clients.

They kept selling funds through intermediaries, but used technology to improve customer relations. The American Funds website, which catered to advisers, was remade to include information for retail clients as well. And the company developed a platform called North American Distribution Intelligence Augmentation, or Nadia, that draws data from digital traffic, phone calls, and other interactions to help its sales force anticipate client questions and demands from the advisers who sell American Funds.

More important, it found success in selling products designed to achieve specific investor goals, such as saving for a college education or retirement. Last year its 11 target-date retirement funds had net inflows of $22 billion, or $14 billion more than the company as a whole, according to Bloomberg estimates.

With $120 billion in assets as of March 31, American’s family of target-date funds is now the industry’s fifth-largest. “People like that simplicity,” Lovelace says. “If you put them in something called the 2050 target-date fund, the label reminds them this isn’t for trading. You hold the 2050 fund because you’re going to be 65 in 2050.”

Last year’s fourth quarter, when U.S. stock indexes dipped into bear market territory, was a big test. The American Funds 2020 Target Date Retirement fund beat T. Rowe Price, Vanguard, and JPMorgan SmartRetirement funds by more than a percentage point, says Jim Scheinberg, chief investment officer of North Pier Fiduciary Management, a Los Angeles consulting company.

Capital Group also found ways to cut costs. It started providing funds that eliminate the upfront sales fees that traditionally induced advisers to sell its products. In January 2017 it began offering “clean shares,” with fees as low as 33¢ per $100, that strip out distribution fees and commissions collected by advisers.

Portfolio managers with opposite views of the same securities exchange them internally, eliminating external transaction fees. When the firm’s 70 traders buy and sell securities externally, they do so in blocks that are small for a company of Capital Group’s size, to avoid influencing market prices unfavorably. The company has invested in Luminex Trading & Analytics LLCand IEX Group Inc., two alternative exchanges that aim to enhance trading efficiency.

Performance is the priority. Net of fees, most American Funds have beaten their benchmarks by an annual average of 1.5 percent over 3-, 5-, 10-, and 20-year periods, according to Armour. “People are too fixated on fees,” he says. “They should be fixated on their total return after all fees.”

That argument has gotten through to some people. Last year, Capital Group attracted $7.8 billion in net new client money. But Vanguard raked in $230 billion, fueled by fees as low as 4¢ per $100 under management—about one-tenth the cost of Capital Group’s cheapest funds. Fidelity Investments, with $2.4 trillion in assets, took the trend to the extreme in August by offering the industry’s first zero-fee indexed mutual funds.

This year the amount of money in passive U.S. equity funds is expected to surpass active funds for the first time, with most new cash flowing into the most basic ETFs, according to Alex Blostein, a Goldman Sachs Group Inc. analyst who follows asset managers and brokerage firms. “For a lot of the population, that’s probably OK,” he says.

For Lovelace, that trend only reinforces his commitment to the research-focused investing style he inherited from his grandfather and father. “This Capital System is different and unique,” he says. “And it works. That’s special. Why would I change that?”