(ETF Trends) U.S. equities were rolling through 2019 after a lackluster fourth quarter, but sputtered in May as volatility from U.S.-China trade deal negotiations breaking down threw a speed bump in front of the capital markets.

Morningstar, Inc., a leading provider of independent investment research, recently reported estimated U.S. mutual fund and exchange-traded fund (ETF) fund flows for May 2019. Overall, passive U.S. equity funds saw $2.7 billion in outflows while active U.S. equity funds lost $12.9 billion to outflows in May–$15.6 billion combined.

With additional funds reporting assets after the April fund flows report published, Morningstar data shows about $89.0 billion between active and passive U.S. equity funds reaching parity. Morningstar estimates net flow for mutual funds by computing the change in assets not explained by the performance of the fund, and net flow for U.S. ETFs shares outstanding and reported net assets.

Morningstar’s report about U.S. fund flows for May is available here. Highlights from the report include:

-

Fund flows were weak across the board in May, with long-term funds losing nearly $2.0 billion to outflows, the worst month year-to-date as investors cut risk. Money-market funds saw inflows of $82.0 billion, the group’s second-best month in 10 years.

-

Among category groups, taxable-bond inflows fell from $42.6 billion in April to $15.4 billion in May, the group’s worst showing year-to-date. Overall, credit-oriented high-yield bond and bank loan funds fared worst, losing $5.8 billion and $3.1 billion to outflows, respectively.

-

Among all U.S. fund families, Vanguard led with $16.7 billion in inflows, followed by $5.1 billion from Fidelity; iShares’ flows were flat. At the other end of the spectrum, State Street Global Advisors saw $22.6 billion in outflows, followed by Invesco’s $5.8 billion in outflows.

-

Invesco QQQ Trust, which holds a Morningstar Analyst Rating™ of Neutral, saw outflows of $3.3 billion in May. Conversely, active-oriented American Funds had $2.7 billion in inflows, with much of that demand coming through its target-date lineup.

To view the complete report, please click here.

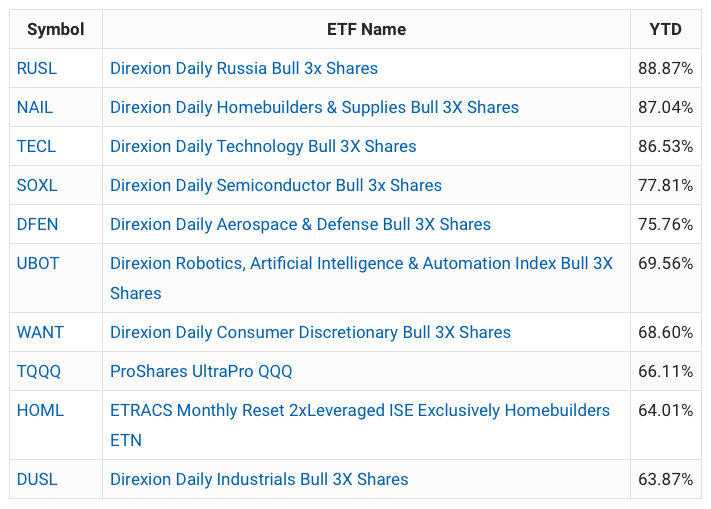

Leveraged funds saw the lion’s share of gains, and here are the best-performing equity funds thus far in 2019: