If 2016 can be summed up as stable growth and rising prices, what does that mean as we look forward?

With recent changes in governments on both sides of the Atlantic, inflation in the near term is more likely to accelerate.

Substantial Price Increases in the United Kingdom

In the United Kingdom, the pound sterling has sold off about 15% following the Brexit referendum, and several producers have begun to put through substantial price increases across the consumption spectrum. Large technology companies pushed through increases of 20% and greater on their products earlier in the fall, while others succeeded in raising prices by 10% across a range of white goods.

The public row between large food companies and grocery retailers over Marmite, a popular food spread, resulted in one large food company backing down from increasing the price on Britain’s quintessential food. What was less widely reported was that a smaller grocery chain quietly increased prices by 12.5%. Over time, others are sure to follow.

U.S. Policymaking: Highly Stimulative and Inflationary

In the United States, the picture is similar. Recent changes to both the executive and legislative branches of government suggest that U.S. policymaking will be highly stimulative and inflationary for what is already an expansion in its late stages.

Promised infrastructure spending may help create construction jobs, but with unemployment already below 5%, it will also likely lead to higher inflation.

Tax cuts—favored by both the executive and legislative branches—are likely. If they materialize at levels close to what has been promised, the after-tax return on capital of U.S. corporations is likely to increase, stimulating more economic activity, higher inflation, and more inflows of capital from abroad.

At this point we know very little about what actual trade renegotiations will be pursued by the Trump administration. Therefore, the impact on economic growth and the U.S. dollar is ambiguous. What is nearly certain is that any short-term restrictions or sudden changes to import and export patterns, or any restrictions on the locations of suppliers (and ultimately disruption to supply chains), will lead to not only disruption in the procurement of goods, but also higher prices for those scarce goods. In other words, any short-term disruption to trade will lead to higher prices at home.

Don’t Close the Door on Emerging Markets

But rising U.S. inflation and interest rates need not spell the end of better performance in emerging markets. Bouts of volatility notwithstanding, this highly heterogeneous group of countries is unlikely to repeat the protracted period of underperformance in the aftermath of the 2013 “taper tantrum” episode.

In 2013, most large emerging market economies had large and deteriorating current account deficits. Today the situation is different, as external deficits have been improving.

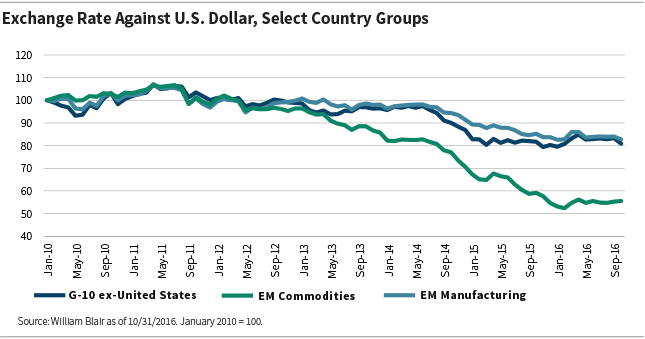

While emerging market currencies have taken the brunt of the adjustment so far, a closer look suggests that most of that adjustment has occurred in the commodity-intensive economies—those countries that rely most heavily on exporting commodities for income.

If we compare emerging market manufacturing countries with their developed-market peers in terms of foreign exchange movements against the U.S. dollar, we see that their fortunes have been similar, as the chart below illustrates.

So, there will likely be bouts of volatility ahead, but it may be premature to close the door on emerging markets for several years.

Any statements or opinions expressed are those of the author as of the date of publication, are subject to change without notice as economic and markets conditions dictate, and may not reflect the opinions of other investment teams within William Blair Investment Management, LLC or the Investment Management Division of William Blair & Company, L.L.C.

This material is provided for informational purposes only and is not intended as investment advice or a recommendation to buy or sell a particular security. Any investment or strategy mentioned herein may not be suitable for every investor.

Factual information has been taken from sources we believe to be reliable, but its accuracy, completeness or interpretation cannot be guaranteed. Investments are subject to market risk. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be interpreted as investment advice, as an offer or solicitation, nor as the purchase or sale of any financial instrument. Statements concerning financial market trends are based on current market conditions, which will fluctuate.

William Blair does not provide legal or tax advice. Please consult your tax and/or legal counsel for specific tax questions and concerns.

Copyright © 2016 William Blair & Company, L.L.C. "William Blair” is a registered trademark of William Blair & Company, L.L.C. No part of this material may be reproduced in any form, or referred to in any other publication, without express written consent.