In a pivotal moment for the cryptocurrency industry, the US Securities and Exchange Commission (SEC) has opted not to challenge a significant court ruling that could open the door for Grayscale Investments LLC to introduce a spot Bitcoin exchange-traded fund (ETF).

This decision, which comes after the DC Circuit Court of Appeals overturned the SEC's initial rejection of Grayscale's proposal, has far-reaching implications for investors and the evolving crypto landscape.

The August ruling by the DC Circuit Court of Appeals marked a turning point in the crypto world. In a majority decision by three judges, the SEC's denial of Grayscale's proposal was deemed "arbitrary and capricious." Judge Neomi Rao, in particular, criticized the regulator for failing to adequately explain its rationale behind the rejection.

Scott Martin, Managing Editor, The Wealth Advisor, sat down with Dave Lavalle, Global ETF Head at Grayscale Investments last week, to discuss their groundbreaking journey.

Martin expressed his admiration for Grayscale's persistence in pursuing the conversion of GBTC into an ETF. Dave explained that GBTC, with a market value of approximately $16-17 billion, is a private placement publicly quoted on the OTC (Over-The-Counter) markets.

However, it lacks simultaneous creation and redemption, a crucial feature of an ETF. Consequently, GBTC behaves more like a closed-end fund, trading at premiums and discounts to its net asset value.

Lavalle emphasized that Grayscale Investments always envisioned GBTC as an ETF. They firmly believed that converting it into an ETF would provide investors with numerous benefits. An ETF structure would allow for simultaneous creation and redemption, ensuring fair and transparent trading. This would enable investors, including wealth managers and financial advisors, to easily incorporate GBTC into their portfolios. Dave's passion for making GBTC accessible to all investors was evident throughout the conversation.

Martin acknowledged that not all advisors can trade closed-end investment trusts as easily as they can ETFs. This is where the conversion of GBTC into an ETF becomes crucial. By bringing this product to market in an ETF wrapper, Grayscale Investments aims to make Bitcoin, the underlying asset of GBTC, available to everyone in a ubiquitous and transparent manner.

Grayscale's plan to utilize a battle-tested ETF wrapper, a 33 ACT Delaware grantor trust, to provide investors with the opportunity to diversify their portfolios and incorporate Bitcoin at their desired allocation.

The conversation delved into the significance of an ETF for both institutions and enthusiasts. Scott highlighted the ease of allocation for advisors and the confidence it would instill in investors.

An ETF structure would make investing in Bitcoin more accessible and provide a unique opportunity to purchase GBTC at a discount to its asset value. Grayscale Investments firmly believes that a Bitcoin ETF can serve as a building block in investors' portfolios, especially for those who are long-term believers in the cryptocurrency.

Lavalle also addressed the concerns regarding the availability of GBTC on different platforms. While the product can currently be purchased on platforms like Schwab, Fidelity, and TD Ameritrade, its availability on the OTC markets depends on the platform being used. Grayscale Investments aims to overcome these limitations by converting GBTC into an ETF, making it widely accessible to investors across various platforms.

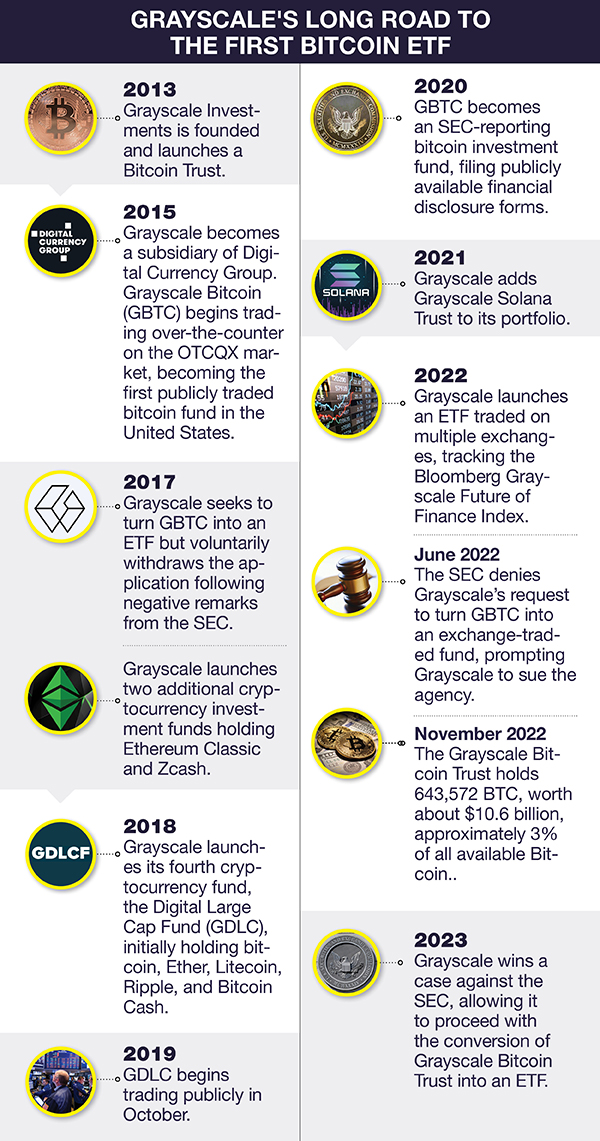

The story of Grayscale Investments' journey towards ETF innovation is one of determination and resilience. Despite initial setbacks, they remained committed to their vision of providing investors with the benefits of an ETF. Their victory in the DC Circuit Court of Appeals marked a significant step forward in their mission. Grayscale's journey started in 2013, 10 years ago and is still ongoing.

It was evident that Grayscale Investments' passion for ETF innovation and their dedication to investors' needs were unwavering. Their relentless pursuit of converting GBTC into an ETF showcased their commitment to pushing boundaries and driving progress in the financial industry. With their eyes set on the future, Grayscale Investments continues to pave the way for innovation in the world of ETFs.

Grayscale Investments, a prominent player in the crypto investment space, has long advocated for the conversion of its trust into an ETF. They argue that this conversion would offer numerous benefits to investors, primarily enabling easier creation and redemption of shares. Currently, the trust operates under a closed-end structure, which limits investors' ability to redeem shares during price declines, leading to trading at substantial discounts compared to the underlying Bitcoin value.

Following the August court ruling, Grayscale's Bitcoin Trust (GBTC) experienced a notable surge in value, outperforming the cryptocurrency itself. The discount between GBTC's price and its underlying holdings, which had once exceeded 45%, narrowed significantly to below 20%. This development underscored the market's optimism regarding the potential conversion to an ETF structure.

The decision by the SEC not to seek further legal recourse in this matter further solidifies the prospect of Grayscale's transformation into a Bitcoin ETF. The agency's deadline for requesting a new hearing came and went, signaling its willingness to accept the court's verdict.

The SEC had initially argued that Bitcoin trading platforms lacked sufficient surveillance mechanisms to detect fraud and manipulation. However, the appellate court judges sided with Grayscale, highlighting inconsistencies in the SEC's stance, especially in light of its approval of Bitcoin futures-based exchange-traded products.

While the three-judge panel was unanimous in its ruling, the SEC still had the option to request an "en banc" hearing involving all appellate court judges. However, the agency has chosen not to pursue this avenue, affirming its acceptance of the court's decision.

Grayscale's trust, which currently operates as a closed-end fund, has often seen its market price deviate significantly from the actual value of the Bitcoin it holds. As of the most recent close, the trust was trading at $20.24, roughly 15.9% below the value of its underlying assets. The potential conversion to an ETF is expected to eliminate this discount, aligning the market price more closely with the Bitcoin's actual value.

Perhaps even more significant is the indication that the SEC's stance on spot Bitcoin ETFs may be softening. Major financial institutions, including BlackRock, Fidelity Investments, and Invesco, have submitted filings to launch Bitcoin ETFs.

While the SEC retains the authority to deny Grayscale's application on different grounds not addressed in the court's ruling, this recent development signals that the regulatory environment is becoming more favorable for the broader introduction of Bitcoin ETFs.

It's essential to note that Grayscale and other fund firms seeking to bring crypto-based products to market must navigate additional regulatory approvals. Nonetheless, Friday's decision by the SEC marks a critical milestone on the path toward making Bitcoin ETFs a reality.

The SEC's decision not to challenge the court's ruling has ignited optimism within the cryptocurrency community. Grayscale's journey toward transforming its trust into a Bitcoin ETF represents a significant step forward for both investors and the broader crypto industry.

As regulatory barriers appear to soften, the prospect of Bitcoin ETFs becoming a reality grows ever closer, potentially reshaping the landscape of crypto investments for years to come.