Many large-cap strategies overlook the biggest names in the S&P 500—an omission that can quietly erode performance and increase unintended risks. The Principal U.S. Mega-Cap ETF (ticker: USMC) offers financial advisors a tool to help address that blind spot. With a rules-based, cost-efficient approach, USMC seeks to enhance exposure to the market’s most dominant, financially sound companies while delivering the characteristics investors often seek in actively managed portfolios.

In an interview with The Wealth Advisor’s Scott Martin, Marc Dummer, managing director and client portfolio manager at Principal Asset Management, discussed how USMC aims to deliver an elegant solution for allocating to mega-caps without shifting into thematic territory. “We wanted to fill a gap in a fee-efficient way,” Dummer says. Priced at just 12 basis points, USMC provides targeted exposure to a segment that is often underrepresented in advisor portfolios.

Addressing the Mega-Cap Allocation Gap

Many large-cap mutual funds tend to “drift down” the market-cap spectrum in search of alpha, leaving top-tier companies underweighted. That movement creates a silent but significant gap in many portfolios—especially those using core-plus structures. Dummer explains that USMC was designed to accompany those strategies rather than replace them.

“We typically deploy it is as a complement to our large-cap managers,” he says. “In a strategic allocation, if we have an allocation to large cap, 80% would be in our typical large-cap managers and 20% would be in USMC to offset their propensity to be underweight these largest companies.”

Dummer also notes that portfolios often unintentionally underweight household names like Apple and Microsoft—not because they’re overvalued but because large-cap managers simply don’t hold them at their index weights. “What you’ll find if you look at your own large-cap exposure, you probably are underweight those largest companies without knowing it,” observes Dummer.

Defensive Growth from Market Leaders

The idea that mega-cap stocks are overvalued is common but often misguided. According to Dummer, the largest companies are expensive for good reason. They tend to be dominant, margin-protecting entities that may play both offense and defense when markets become volatile.

“These are some of the most defensive areas of growth because they are monopolistic in nature,” he points out. “These companies tend to be price setters, meaning that if the input costs are going up because of trade wars, they can often increase their unit costs, their revenues, to maintain their margins.”

USMC aims to capitalize on that dynamic by emphasizing both size and financial quality of holdings. That combination creates a profile intended to be well-suited to today’s market, where macro uncertainty is high and durable growth matters more than ever.

“Each PM has their own views, but our general thesis is right now we’re not being paid to take a lot of tracking error risk, meaning our asset allocation. But we do want to lean a little bit more in active management,” says Dummer. “We want to be a little bit more defensive in our equities, and that would be USMC, particularly in the large-cap space.”

A Simple, Repeatable Framework with Active Characteristics

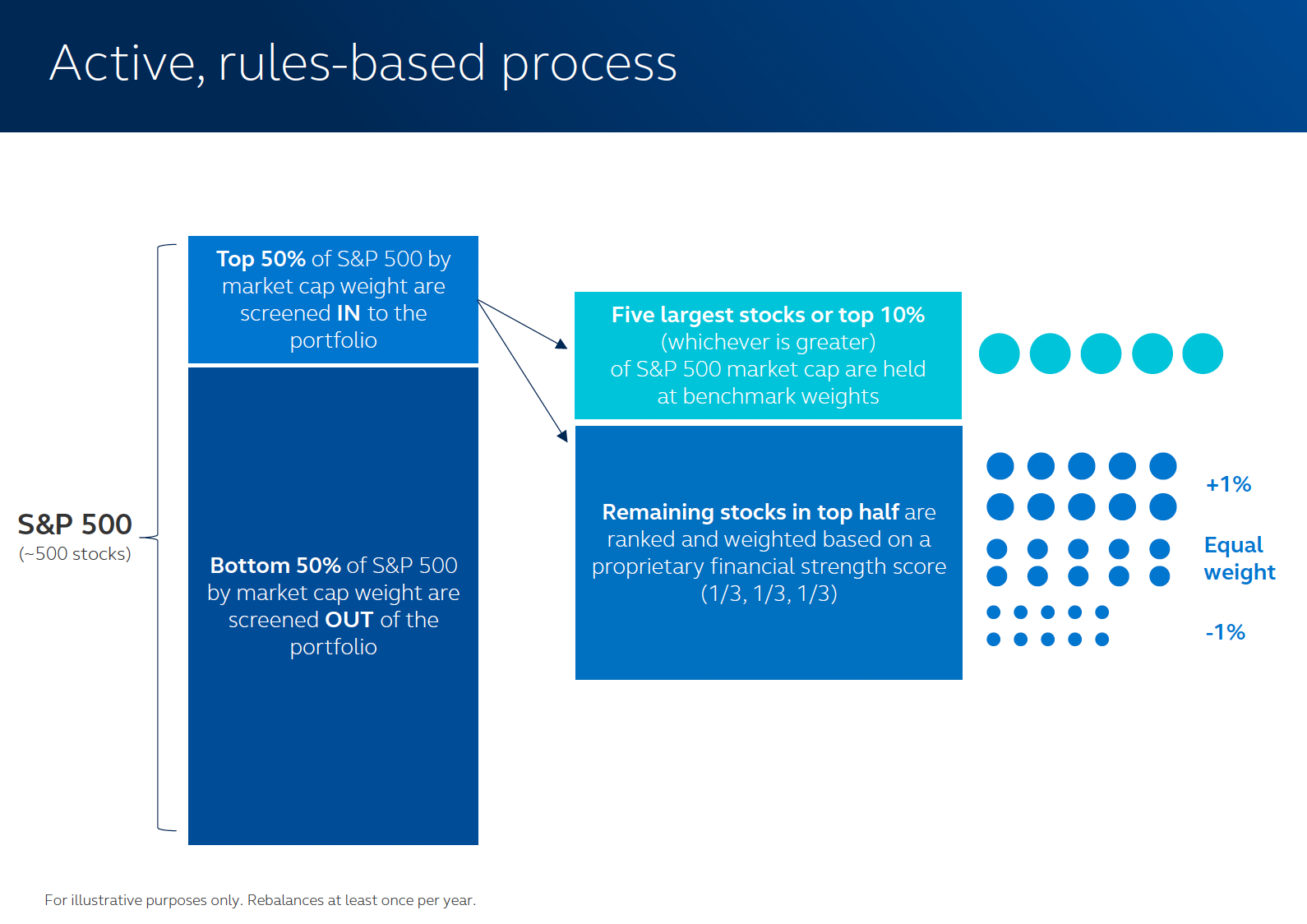

As a rules-based exchange-traded fund (ETF) with potential for core-plus positioning, USMC reflects many active management traits. As Dummer notes, the construction process begins by identifying the top 50% of the S&P 500 by market cap—a number that fluctuates depending on the concentration of the index. When the strategy launched, the top half represented about 40 stocks. Today, it’s closer to 25.

The rules behind USMC are intentionally straightforward. The top 50% by market cap is the only fixed threshold; weighting within that universe is where the process becomes more nuanced.

The Principal process then assigns weights to that top 50%. The largest five names receive their index weights, while the remainder are weighted based on a proprietary score that evaluates a range of fundamentals, including free cash flow.

“Once we’ve identified the companies that make the universe, we want to weigh them according to some rules around a financial strength score,” Dummer explains. “That’s typically where we see active management add the most value, and that’s been the experience of this portfolio.”

“A third get an equal weight, a third get an equal weight plus 1%, and a third get an equal weight minus 1%,” Dummer explains. “That adjustment of plus 1% or minus 1% is based on a rules-based financial strength rating scheme.”

By avoiding rigid mandates like a fixed number of holdings, the strategy remains nimble and responsive to market concentration. That flexibility has proven especially useful as a handful of names continue to dominate index returns.

The emphasis on financial strength further enhances the portfolio’s durability. “It truly does show up in the characteristics and in the track record,” Dummer says.

The result is a strategy that seeks to provide both upside participation and strong downside mitigation. “I would encourage advisors to look at the up/down capture ratio during periods of market sell-off like COVID or during the original invasion of Ukraine,” says Dummer. “See how this strategy held up. Our history has shown that we tended to outperform in those down markets.”

Low Cost with High Utility

USMC’s 12-basis-point expense ratio stands out in a space where quality mega-cap exposure can come at a premium. For advisors, that attractive fee opens up strategic flexibility across the portfolio.

“The relatively inexpensive fees allow you to set your fee budget to spend it elsewhere where active management can also add value,” Dummer believes. “Having a competitive fee on this portion of the S&P 500 with elements of active fundamental underlying allows you to spend that fee budget in midcaps or in preferred securities or high yield.”

Dummer adds that the way advisors talk about fees has changed. “We used to live in a world where people would say, Get me the best net-of-fee returns. Right now, we’re in a world where people will say, Here’s the fee I’m willing to pay. Get me the best return subject to that fee.”

In that context, USMC offers an efficient building block with clear value—in terms of both exposure and cost.

Why USMC May Be Relevant Right Now

Markets remain unpredictable, with growth concerns, geopolitical risk, and inflation all weighing on sentiment. Yet many mega-cap companies continue to deliver consistent results, underpinned by their scale, pricing power, and balance sheet strength.

For advisors seeking a core-plus equity allocation that aims to bring resilience without sacrificing return potential, USMC may offer a compelling option. The strategy is designed to complement existing positions, fills an exposure gap, and do so at a price point that might allow for broader flexibility across the portfolio.

That gap, Dummer emphasizes, is both common and often overlooked. “What you’ll find, most advisors are meaningfully underweight the largest companies in the S&P 500, unintentionally. So just construct out that bias, and that gap, by adding USMC.”

_____________________

Additional Resources

_____________________

Disclosures

Carefully consider a fund’s objectives, risks, charges, and expenses. For a prospectus, or summary prospectus if available, containing this and other information, visit www.PrincipalAM.com or call sales support at 800-787-1621. Please read it carefully before investing.

ALPS Distributors, Inc. is the distributor of the Principal ETFs.

ALPS Distributors, Inc. and the Principal Funds are not affiliated.

Unlike typical ETFs, there are no indices that the Principal U.S. Mega-Cap ETF attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager.

Asset allocation and diversification do not ensure a profit or protect against a loss.

Investing in ETFs involves risk, including possible loss of principal. ETFs are subject to risk similar to those of stocks, including those regarding shortselling and margin account maintenance. Investor shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Ordinary brokerage commissions apply.

Equity investments involve greater risk, including heightened volatility, than fixed income investments.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management is a trade name of Principal Global Investors, LLC. Principal Global Investors leads global asset management at Principal®.

MM14547 | 6/2025 | 44350266-122025 | PRI001666-122025