Most robo-advisors will fail this year due to unsustainable business models, lack of branding opportunities and an inability to deal with bear markets, Sara Grillo writes on Advisor Perspectives.

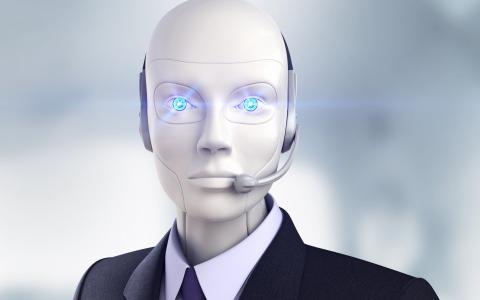

Several Insurmountable Issues Mean Robo-advisors Are Doomed to Fail

Most robo-advisors lack viable business models and have problems with revenue, which owners put down to them being in their early stages, she writes. However, when robo-advisors continue to have present values of less than zero after several years, they will be scrapped, Grillo writes.

The problem is that robo-advisors are aimed at the mass-affluent, she writes. Those who lack the assets to qualify for a human advisor already have low-cost financial products available to them, negating the need for a robo-advisor, according to Grillo. Furthermore, firms are mistaken if they believe large portfolios will move to robo-platforms, she writes. This means the margins aren’t high enough, the platforms aren’t scalable and the robos won’t thrive, she writes. Moreover, firms that offer robos to existing clients may hurt themselves as they transfer clients to lower-fee services, Grillo writes.

There is also no way to differentiate one robo-advisor from another, meaning firms can’t set themselves apart, according to Grillo. Firms have tried to tackle this by claiming that their robo-advisor has good customer support or a human behind the model, she writes. This undermines the idea of a robo, and as the model is scaled, the overheads from salaries would make them unsustainable, according to Grillo.

Furthermore, most of these robo-advisors were created after the financial crisis, and therefore aren’t equipped to deal with bear markets, she writes. Human advisors allow for damage control when markets crash—and when they do, robos will fall, Grillo writes.

Robo-advisors were designed to reach investors through the internet, but this is not the way to do it, she writes. Instead, advisors should move away from the mass affluent and target bigger portfolios, which will already align with the services they offer, according to Grillo.