(Forbes) Here is what matters if you've made it and want to keep it.

Do the financial markets have your attention? I assume so. After all, Wednesday's 800-point drop in the Dow was the worst day in the U.S. stock market this year. And while many investors missed it, the December 2018 plunge in stock prices capped off a 20% decline which started in October. That could have put a big divot in the plans of folks recently retired or in the late stages of their careers.

Stumbling at the finish line?

Demographics tell us that there is massive group of people who are between 55 and 70 years old. They are the majority of the "Baby Boomer" generation. Many of them have built very nice nest eggs, thanks to a robust U.S. economy over the last 40 years. That period of technological innovation and globalization of the economy also produced four decades of generally falling interest rates. That's provided a historic opportunity to build wealth, if you saved well and invested patiently.

But now here we are, with a stock market near all-time highs and interest rates crashing toward zero. The tailwind that lifted Baby Boomers in their "accumulation" years may flip to a headwind, just in time for them to start using the money.

Focus on what matters

At this stage of their investment life, Baby Boomers are tempted from all directions. They are told to bank on index funds, 60/40 portfolios, structured products and private partnerships. And, while there are merits to each, I am telling you what I see as someone who has been hanging around investment markets since this Baby Boomer was a Wall Street rookie in the beloved World Trade Center in NYC: much of it is bunk. It’s a distraction. It’s a sales pitch.

Take these over-hyped attempts by wealth management firms to boost their bottom line and scale their businesses, and bring your attention to your own priorities. Today, as much as any time in the past 10 years, your focus should be on true risk-management.

That does not necessarily mean running to cash. That is an outright timing move, and it borders on speculation. But it does mean that the intended use of your accumulated assets (when you need it, how much you need, and how you will navigate the markets of the future) should be

inward-looking. It should not be based on trying to guess what the stock market is going to do.

Rate cut? Check. Inversion? Check. Giant stock market drop? We'll see.

The big news on Wednesday was the "inversion" of a closely-watched part of the U.S. Treasury yield curve. Translated to English, that means for the first time since 2007, U.S. Bonds maturing in 10 years yielded less than those due in 2 years. This is far from the first inversion we have seen between different areas of the Treasury market. However, it is the one that is most widely-followed as a recession warning signal.

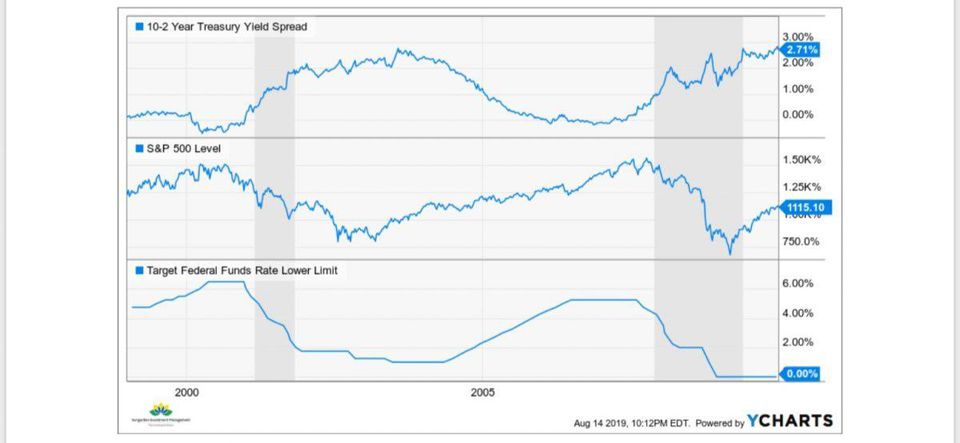

The chart above shows 3 things that were essentially in sync around the time the last 2 stock bear markets began. The 10-2 spread inverted, but then quickly reverted to normal. The Fed cut interest rates for the first time in a while. And, the S&P 500 peaked in value, and fell over 40% from that peak.

Let that sink in, given what we have witnessed in just the past 2 weeks. Then, fast-forward to today, where we find ourselves in a very similar situation regarding inversion and the Fed. See this chart below:

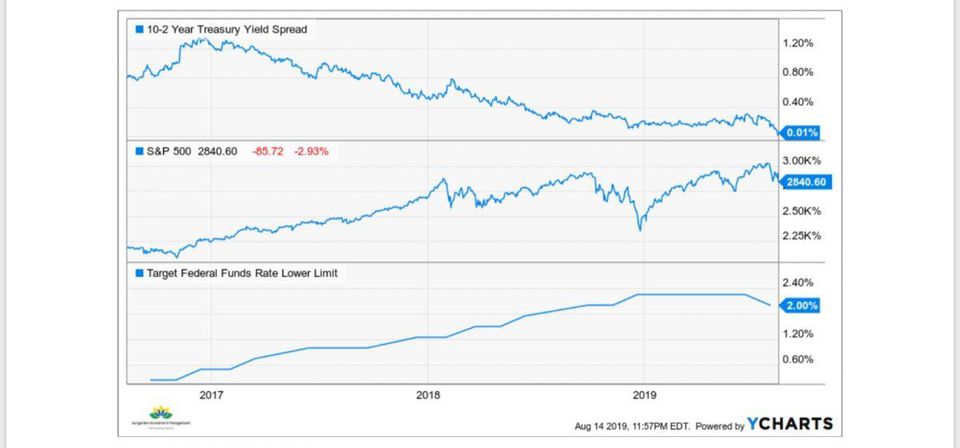

What stands out the most to me in that chart is how the spread between the 10-year and 2-year yields is almost perfectly opposite that of the S&P 500's price movement. That is, when the 10-2 spread is dropping, the S&P 500 is usually moving higher. But when that spread starts to rise, at it is likely to soon, the S&P 500 falls...hard. As a career chartist, I just can't ignore that.

I have been writing about the threat of an eventual "10-2 inversion" in Forbes.com since April, 2017. It finally happened this week, 19 months into what increasingly looks like a period of muted returns for investors. That is, if they follow rules identical to those they followed for the past 10 years.

Recessions are bad, but this is worse

We saw on display this week what I have been talking about since early last year: that it will not take the declaration of a recession to tip the global stock market into a panic-driven selloff that rips through retirement efforts. All that is needed is for stock prices to follow through to the downside is to actually see the market react to the preponderance of evidence that has been building for a while now.

In other words, it is the market's fear of the future (recession) and not the actual event that is most important. By the time a recession is officially declared, you won't need to react. The damage will already be done.

Specifically, a slowing global economy, excessive "easy money" policies by the Fed and its global counterparts, and a frenzied U.S. political environment. This has shaken investor confidence, and now the only thing that ultimately matters in your retirement portfolio: the prices/values of the securities you own, is under pressure.

What to do about it

First, don't fall prey to the hoards of market commentators whose livelihood depends on progressively higher stock prices. Corrections are not always healthy, diversification is often a ruse, and long-term investing is for 25 year-olds!

For those who have "fought the good fight" to get to the precipice of a retirement they have darn well earned, the last thing they want is to have this inanimate object (the financial markets) knock them back toward a more compromised retirement plan.

The best news about today's investment climate is that the tools we have to navigate through them are as plentiful as ever. Even in a period of discouragingly low interest rates for folks who figured on 4-6% CDs paying their bills in retirement, bear markets in stocks and bonds can be dealt with, and even exploited for your benefit.

Bull or bear? You should not care!

Maybe this is not "the big one" that bearish pundit have been warning about. Perhaps it is just another bump in the road of a historically long bull market for both stocks and bonds. But again, market timing and headline events like 10-2 spreads, recessions and the like are not your priority.

What your priority is, if you want to improve your chances of success toward and through retirement, is something different. Namely, to get away from the jargon and hype of financial media, simplify your approach, and take a straightforward path toward preserving capital in a time of uncommon threats to your wealth. I look forward to sharing insight on that in the coming days.