The search for tax-aware income strategies continues to intensify as advisors reevaluate traditional fixed-income tools in light of persistent rate changes, credit pressures, and growing client demand for more efficient yield solutions. One ETF positioned to potentially meet all three needs is the Principal Spectrum Tax-Advantaged Dividend Active ETF (ticker: PQDI), which combines credit-conscious income generation with active management and tax efficiency.

In an interview with The Wealth Advisor’s Scott Martin, Lester Matthews, Product Manager at Principal Asset Management, discussed the ETF’s focus on qualified dividend income (QDI), its active selection process across the preferred and capital securities universe, and how financial advisors can incorporate the ETF into income-oriented client portfolios.

Centering Income Strategies on QDI

PQDI, whose investment manager is Spectrum Asset Management, an investment team within Principal Asset Management, distinguishes itself through a consistent focus on QDI, which may help investors improve their after-tax yield profile—particularly those in higher tax brackets. “What makes it so cool is that it has a focus on qualified dividend income,” Matthews says. “And if you looked at our supplements for the last three years, it’s 100% QDI.”

Instead of exposing investors to income taxed at ordinary rates, the fund invests in securities likely to generate qualified dividends, which may receive favorable tax treatment. “For clients investing in preferreds, the focus is on the dividend income from the product, but the gravy on the potatoes is the QDI,” Matthews says.

The QDI-focused design may be particularly attractive for taxable accounts or clients seeking income without taking on unnecessary credit or duration risk from traditional high-yield bonds.

Investing Across the Full Preferred and Capital Securities Market

PQDI leverages a broader set of income-generating instruments than many traditional preferred ETFs, allocating across institutional $1,000 par preferreds, $25 par exchange-traded preferreds, and contingent convertible (CoCo) bonds issued by large European banks.

“All three sectors are part of Spectrum’s investible universe,” Matthews says, “And PQDI does its job in finding the best of value and combining that and providing a diversified portfolio of income through those three sectors.”

The inclusion of all three segments helps the team to identify income opportunities across different rate environments and capital structures. The team doesn’t just search for high yields—they evaluate where in the capital stack value exists, while ensuring a focus on investment-grade issuers.

“What Spectrum does that separates us from competitors is we’re looking at the credit quality of the issuer and making sure that’s investment grade, go down the capital structure and decide where to invest in a particular company,” Matthews says. “Preferred and capital securities can be very complex, and that’s one of the main reasons you need active management.”

Active Management as a Core Feature

The complexity of preferred securities—with their callable features, reset provisions, and unique tax dynamics—makes active management essential. This is especially true for CoCo securities, which are often inaccessible to individual investors and typically require institutional-level access. For advisors managing taxable accounts, access to those income streams may be limited without an active manager.

“The asset class itself is nuanced,” Matthews says. “So, to be able to access this asset class through an ETF is quite compelling. And there’s not many strategies like this out there.”

How PQDI May Fit into Income Allocations

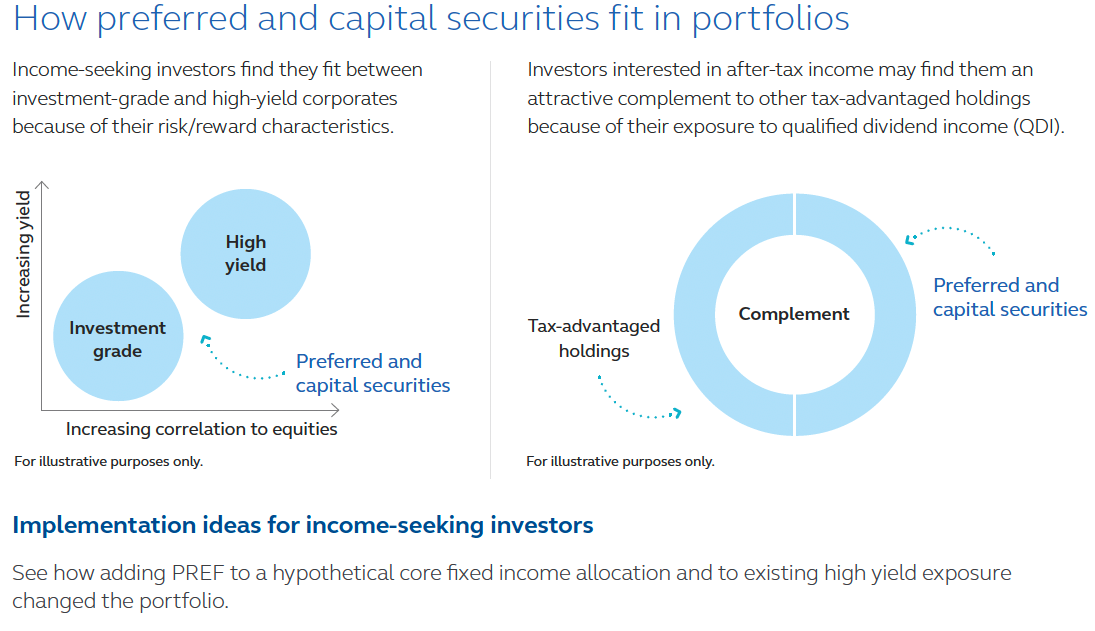

PQDI is designed to play multiple roles within fixed-income strategies, serving as either a core holding for tax-sensitive income or as a satellite position designed to capture undervalued opportunities across the preferred spectrum. Some advisors use it tactically, harvesting discounted securities for elevated yield, while others integrate the fund into the core of a client’s income portfolio.

“It’s fixed income in both of these, whichever one makes the most sense for your client,” Matthews says, referring to PQDI and its sister fund, the Principal Spectrum Preferred Securities Active ETF (ticker: PREF). “We’ve seen from our partner firms that we work with, they use preferred and capital securities, 1% to 10% of the fixed-income bucket, depending on the client’s situation, their goals, what income level they’re trying to achieve.”

For clients overweight in cash or holding excess high-yield debt, PQDI may provide a compelling pivot. Matthews describes scenarios where cash is deployed incrementally into preferreds or where high-yield debt exposure is trimmed in favor of higher-quality income sources.

“We’ve seen it where they slice it into cash because they’ve been overweight cash for a long time, and they need to put it to work finally,” he explains. “And this is a nice stepping stone towards stocks, if they had to. We’ve also seen a slice off equities when things get really volatile and they want to pull back, but they still see some opportunities in the market with the income.”

Differentiating PQDI from PREF—and from Dividend Equities

Both PQDI and PREF are preferred-focused ETFs managed by Spectrum, an investment team within Principal Asset Management, but the two serve different portfolio functions. “One is a core. One is a satellite,” Matthews explains, adding that advisors typically use PREF to diversify away from $25 par retail exposure that clients may already hold, while PQDI leans more toward institutional $1,000 par securities and CoCos but maintains broader diversification across all three sectors.

Matthews highlights how PQDI’s broader mandate creates opportunities that aren’t available through PREF’s more focused approach. When securities trade at discounts as a result of market dislocations, PQDI’s managers can capitalize on these inefficiencies across multiple sectors.

With PQDI, he says, “you can swoop in and get these things at let’s say 85, as an example, and you’re going to [get] four or 4.5% coupon. Eventually, you see these kind of things gravitate as markets fluctuate, rates fluctuate, and people realize, hey, these are too cheap.”

The multisector composition allows PQDI to access higher-yielding CoCos while providing significant tax advantages. PQDI’s distributions are generally taxed as QDI at long-term capital gains rates—typically peaking around 20% plus surcharges—rather than ordinary income rates that can approach 40%. For taxable accounts, this may translate to roughly half the tax burden of traditional bond income.

Importantly, PQDI operates differently from dividend equity strategies. While dividend equity funds focus on companies with histories of dividend growth, preferred securities investing emphasizes credit quality and capital structure positioning rather than projecting increases based on historical patterns.

A Flexible Tool for Tax-Sensitive Income Allocation

For income-focused clients, especially those facing meaningful tax exposure or reduced high-yield opportunity sets, PQDI seeks to provide targeted access to preferred and capital securities that may help improve after-tax return potential. By investing across retail, institutional, and European sectors—and by doing so actively—the strategy allows advisors to customize income strategies for a wider range of client needs.

For advisors building fixed-income portfolios in a rate-aware, tax-aware world, PQDI may provide a differentiated tool—one that aims to deliver quality income from a complex market, through an actively managed structure built for modern client demands.

_____________________

Additional Resources

- Contact Principal Asset Management

- Find out more about Spectrum Asset Management

- PQDI Fact Sheet

- PQDI Summary Prospectus

_____________________

Disclosures

Carefully consider a fund’s objectives, risks, charges, and expenses. For a prospectus, or summary prospectus if available, containing this and other information, visit www.PrincipalAM.com or call sales support at 800-787-1621. Please read it carefully before investing.

ALPS Distributors, Inc. is the distributor of the Principal ETFs. ALPS Distributors, Inc. and the Principal Funds are not affiliated.

Unlike typical ETFs, there are no indices that the Principal ETFs attempt to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager.

Investing involves risk, including possible loss of principal.

Past performance is no guarantee of future returns.

Fixed-income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Risks of preferred securities differ from risks inherent in other investments. In particular, in a bankruptcy preferred securities are senior to common stock but subordinate to other corporate debt. Contingent capital securities (CoCos) may have substantially greater risk than other securities in times of financial stress. An issuer or regulators decision to write down, write off or convert a CoCo may result in complete loss on an investment.

Asset allocation and diversification do not ensure a profit or protect against a loss. Investing in ETFs involves risk, including possible loss of principal. ETFs are subject to risk similar to those of stocks, including those regarding short-selling and margin account maintenance. Investor shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Ordinary brokerage commissions apply.

There can be no assurance as to the portion of the Fund’s distributions that will qualify for favorable federal income tax treatment. The Fund may make investments and pay dividends that are ineligible for favorable tax treatment or that otherwise do not meet the requirements for such treatment, and shareholders must satisfy certain requirements to take advantage of beneficial tax treatment.

ETFs can be tax efficient in that they are exchange-traded and redeem creation units from authorized participants by using redemptions in kind, which are not taxable transactions for the Fund. However, capital gains are still possible in an ETF, and if you reinvest the earnings of the ETF, you may owe taxes on your funds even if you didn’t sell any shares, potentially eating into your returns.

Spectrum Asset Management, Inc. is an affiliate of Principal Global Investors. Spectrum is a leading manager of institutional and retail preferred securities portfolios and manages portfolios for an international universe of corporate, insurance, and endowment clients.

© 2025 Principal Financial Services, Inc.

Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

MM14641 | 8/2025 | 4736424-082026 | PRI001837