Many portfolios appear diversified on the surface but contain unintentional gaps in size and style allocations. Advisors frequently discover they’re missing out on the upside potential of small-cap equities, often avoiding the asset class entirely owing to concerns about liquidity, capacity constraints, or inconsistent profitability. Principal Asset Management offers a targeted strategy for financial advisors facing these challenges: the Principal U.S. Small-Cap ETF (ticker: PSC).

In an interview with The Wealth Advisor’s Scott Martin, Marc Dummer, managing director and client portfolio manager at Principal Asset Management, discussed how PSC is “developed by asset allocators for asset allocators,” designed to address persistent portfolio construction gaps that even sophisticated institutional investors don’t realize they have.

PSC was created by Principal when their investment team discovered gaps in its portfolio construction process—then built a solution that addresses the structural problems limiting traditional small-cap investing. PSC combines fundamental insights with a rules-based structure that seeks to support cost efficiency, scale, and portfolio balance.

Small-Cap Exposure Without the Structural Headaches

PSC isn’t just another small-cap exchange-traded fund (ETF); it’s the Principal team’s answer to small-cap investing challenges such as illiquidity, capacity constraints, and inconsistent profitability. While many investors have grown frustrated with small-cap returns in recent years, Dummer emphasizes that small-cap stocks still might offer meaningful diversification, growth prospects, and compelling valuations relative to their large-cap peers.

“We do find that some advisors don’t have any exposure to small caps, and I would argue that you should,” he says. “Small caps offer higher growth potential, in both earnings growth and revenue growth. They are nimble, so they can expand their margins more quickly, and they offer diversification benefits.”

Regarding diversification, Dummer points out that technology represents nearly 40% of the S&P 500 but accounts for just 12% of the small-cap universe, providing exposure to sectors and economic drivers beyond tech concentration. Additionally, small-cap companies derive roughly 80% of revenues domestically compared to 60% for large-caps.

That domestic focus makes small caps less exposed to global trade tensions and more sensitive to domestic economic strength. “If the trade wars continue and the US growth and employment remains about where it is, you should have a domestic consumer base that can help carry those small-cap companies,” Dummer explains.

Even amid lagging performance, small caps stand out for their margin flexibility and potential to generate alpha through active management. Compared to large caps, where manager outperformance is rare, small caps offer more room for skilled managers to identify inefficiencies.

“In the large-cap space, it’s very hard for a manager to beat the benchmark net of fees,” Dummer says. “In the small cap space, they historically outperform by not only their fees but by an extra margin.”

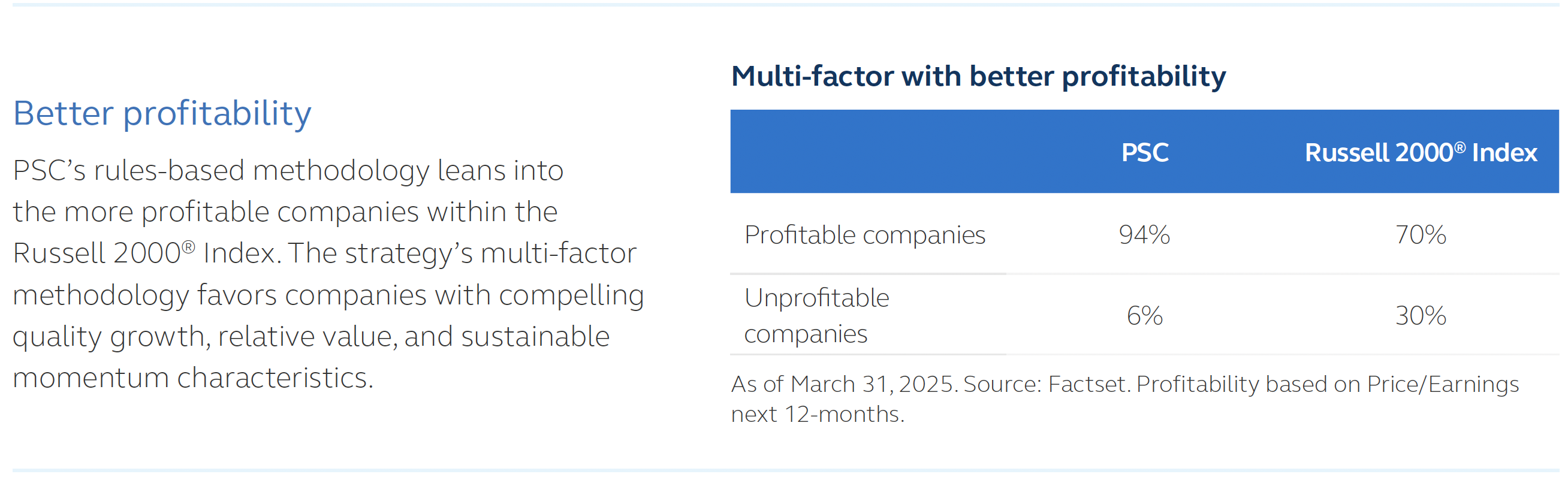

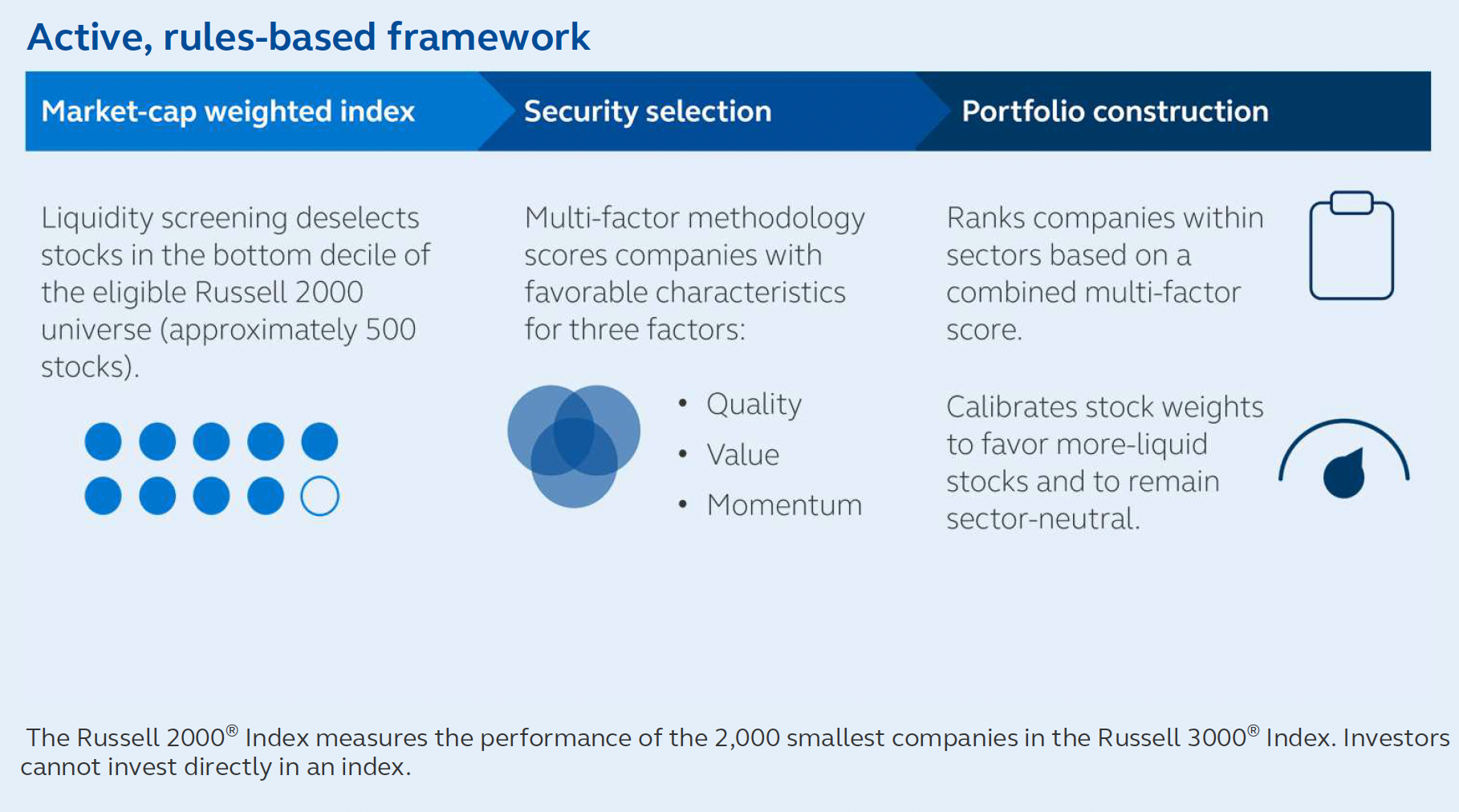

PSC aims to avoid many of the traditional pitfalls in small-cap investing by trimming the least liquid stocks from the Russell 2000 universe, screening for a range of factors, and ensuring sector neutrality at every rebalance. While approximately 30% of Russell 2000 companies are unprofitable, Dummer says, PSC’s exposure to unprofitable names is about 6%.

“We have about 33 factors that we look at to build the portfolio,” he explains. “Roughly, those 33 factors fall into three buckets: quality growth, relative value, and sustainable momentum.” Each company is evaluated within that multifactor framework, and only those that meet specific thresholds make it into the portfolio.

Why Rules-Based Active Management Works in Small Caps

PSC’s structure is designed for scalability and repeatability—traits that are often hard to achieve in actively managed small-cap strategies. In fact, the ETF originated as an internal solution to a real-world constraint that affects advisors across the industry.

“As a $175 billion asset allocator, we have exposure to small caps,” says Dummer. “What we were finding is that many of our small-cap managers were capacity constrained, and if we were allocating to small caps, we could overwhelm their existing capacity.”

Principal created PSC to target the more investable portion of the small-cap universe. “If we can’t buy it in the market, let’s build that ourselves as an asset allocator,” he explains. “And it turns out, it filled the gap for us, and it fills a gap for other asset allocators.”

This Principal solution eliminates the trade-off between active management benefits and scalability. The strategy starts with a filtered universe of approximately 1,500 stocks, screened from the Russell 2000 by eliminating the least liquid decile. From there, a factor-based scoring system selects about 500 stocks that meet the portfolio’s quality, sustainable momentum, and valuation criteria, weighted to be sector neutral.

The result is a repeatable, rules-based strategy that aims to provide the benefits of active management—fundamental screens, quality controls, and risk-aware construction—without the capacity constraints that limit many traditional approaches.

“One of the biggest hurdles I hear when I’m talking with advisors is they just don’t have exposure to small cap,” Dummer says. “PSC is a fee-efficient way to get you exposure to the space.”

The Current Small-Cap Opportunity

Current market conditions create what Dummer considers an especially attractive entry point for small-cap exposure. While large-cap companies trade at expensive levels—averaging around the 90th percentile, meaning they’ve been cheaper 90% of the time—small caps trade in roughly the 30th percentile. “They have rarely been cheaper, yet they have a little bit of a tailwind in the current environment,” he says.

The economic environment adds another layer of support for small-cap companies. “If we are not going into recession and we have falling interest rates, that’s a great environment for small caps historically,” Dummer notes. Small-caps carry significantly more floating-rate debt exposure, he points out, approximately 50% compared to just 5% among large-cap companies, making them more sensitive to potential Federal Reserve rate cuts.

The reason small caps appear inexpensive relative to historical norms relates to recession concerns that may already be priced in, Dummer observes. “Now, those recession concerns seem to be a little overblown, and maybe even if they are real, it’s already been priced into the small cap space,” he says.

Active Management in an Uncertain Environment

While passive strategies dominate many asset classes, small caps remain an area where active management can add meaningful value—especially in volatile conditions.

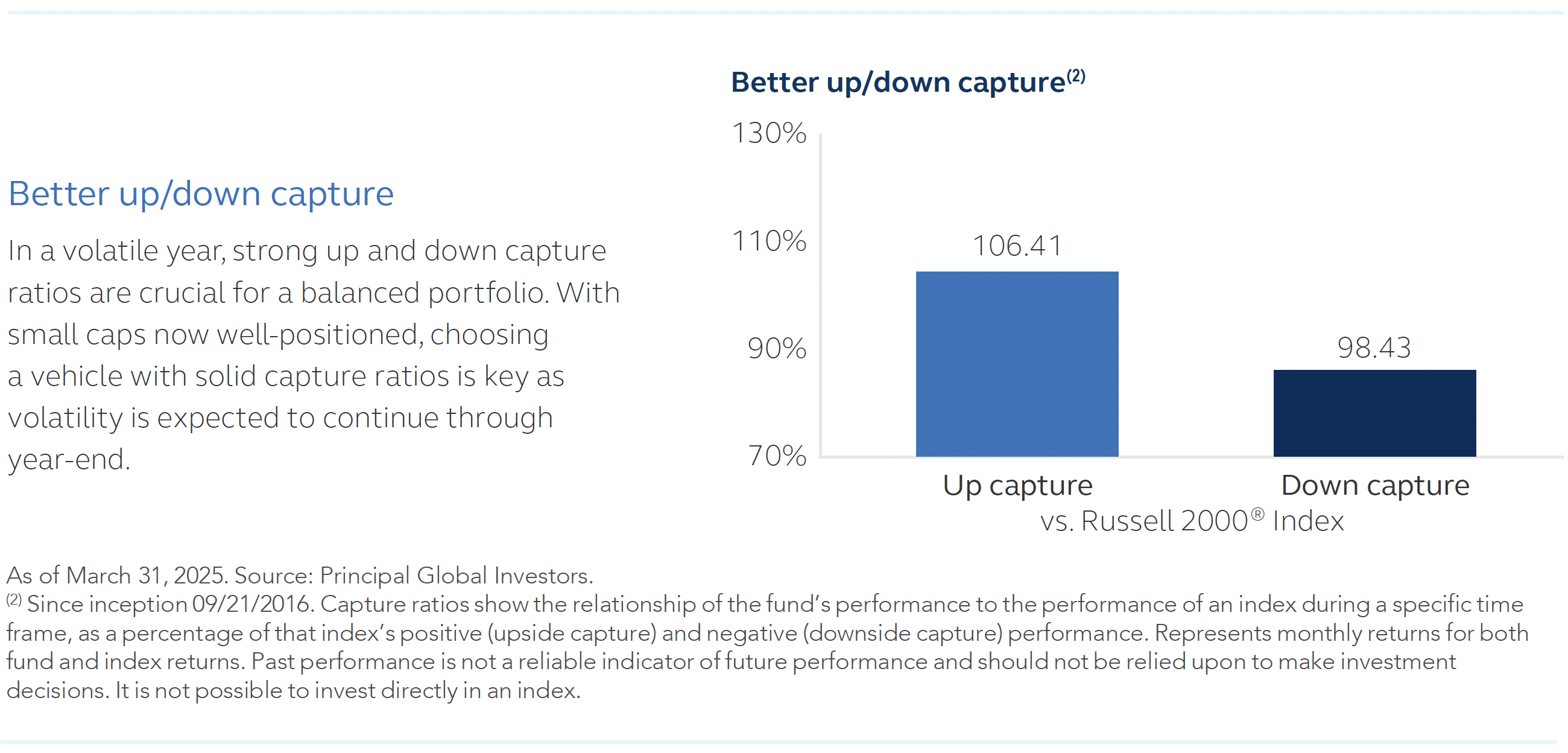

“If you’re worried about the downside right now, given everything that’s uncertain in the economy, you probably want to lean a little bit more into active management,” Dummer believes. “Active management tends to lag on the upside, but it protects more on the downside.”

The PSC rules-based approach provides the benefits of active management—quality screening, risk management, and systematic factor exposure—while maintaining the consistency and transparency that advisors need for portfolio construction. The strategy has demonstrated a 106% up-capture ratio and 98% down-capture ratio as of Q1 2025, he notes.

Completing the Small-Cap Allocation

PSC addresses a common blind spot in advisor portfolios: missing out on small-cap growth potential because of structural constraints in traditional small-cap investing. The strategy is built to solve real portfolio construction problems through clear rules, low fees, and scalable design.

“I don’t consider the portfolio complete without small caps,” Dummer says. “These are the companies that will eventually become midcaps if they survive, and then large caps.”

PSC’s focus on liquidity, profitability, and multifactor selection avoids the common pitfalls of traditional small-cap benchmarks while maintaining sector neutrality and capacity for institutional-level allocations. The rules-based structure mitigates concerns about manager turnover, style drift, or capacity constraints that can limit traditional active small-cap strategies.

By providing fee-efficient access to the small-cap asset class with built-in quality controls and risk management, PSC seeks to enable advisors to complete their equity allocations without compromising on cost efficiency or scalability. The strategy addresses specific portfolio construction gaps while supporting strategic allocation decisions across the broader portfolio.

_____________________

Additional Resources

_____________________

Disclosures

Carefully consider a fund’s objectives, risks, charges, and expenses. For a prospectus, or summary prospectus if available, containing this and other information, visit www.PrincipalAM.com or call sales support at 800-787-1621. Please read it carefully before investing.

ALPS Distributors, Inc. is the distributor of the Principal ETFs.

ALPS Distributors, Inc. and the Principal Funds are not affiliated.

Unlike typical ETFs, there are no indices that the Principal U.S. Small-Cap ETF attempts to track or replicate. Thus, the ability of the Fund to achieve its objectives will depend on the effectiveness of the portfolio manager.

Asset allocation and diversification do not ensure a profit or protect against a loss.

Investing in ETFs involves risk, including possible loss of principal. ETFs are subject to risk similar to those of stocks, including those regarding shortselling and margin account maintenance. Investor shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Ordinary brokerage commissions apply.

Equity investments involve greater risk, including heightened volatility, than fixed income investments. Small-cap stocks may have additional risks including greater price volatility.

© 2025 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management is a trade name of Principal Global Investors, LLC. Principal Global Investors leads global asset management at Principal®.

MM14548 | 6/2025 | 4572316-122025 | PRI001756-122025