On November 6, amid historic turnout, Americans voted for a divided government. Although not all races have been settled yet at the time of this writing, the Republicans won at least an additional three senate seats, expanding their majority and retaining control of the senate. Democrats won back the house, however, and elected seven new governors.

As a result, the political landscape has shifted away from unified Republican control to one in which Democrats have at least a limited ability to block legislation or shape it through bipartisan compromise. Here’s an overview of how we think this changing environment may shape the financial markets and investment advisory practices.

Volatility will likely settle down

The midterm elections remove some of the uncertainty that has been plaguing financial markets, setting the conditions for a more stable investment environment. This will be good news for investors who have been buffeted recently by unusually high volatility.

Since October 1, there have been eight sessions when the S&P 500 Index moved up or down by more than 1%-- the last day like that before October was in late June. Many factors drive market dips and upswings; in this cycle rising interest rates and trade tensions with China have been important influences. However, the uncertainty surrounding a major election has contributed as well, say market experts.

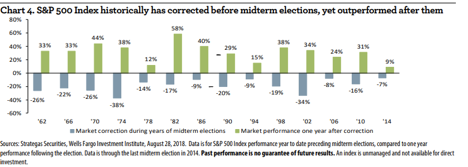

“Historically, in the run-up to the midterms, there’s a lot of volatility and a lot of uncertainty,” says Craig Holke, an investment strategy analyst at the Wells Fargo Investment Institute. “We hadn’t really seen that in the market until this week, when it finally hit.” Holke adds that long-term historical research shows that markets have typically performed well, after the mid-terms once uncertainty has been resolved. (See chart below)

Much of the uncertainty swirled around which party would take power, yet in the long-term, experts say, party control doesn’t have much impact on investment markets. “The fact of the matter is that the markets don’t care which party is in control,” says Jordan Dechtman, founder and CEO of Denver-based Dechtman Wealth Management. “As investment advisors, we respect everyone’s perspective, but the market doesn’t really care. The bigger issue is uncertainty.”

Dechtman adds that political uncertainty is only one of several reasons the markets have been volatile and maybe not the most important one. “I think the midterms by themselves aren’t necessarily the driving force,” he explains. “The two most important forces right now are interest rates and the trade and tariff issues with china. But, quite frankly, both of those issues are going to work themselves out. The Fed is on a very smooth and steady path to raising rates. And as far as China’s concerned, there are some behind the scenes negotiations going on that would suggest this will be addressed once the midterm elections are over. We see this as a buying opportunity.”

The impact of divided government

The main change, post-midterms, is that the balance of power has shifted slightly in the favor of the Democrats, who now control the House. As a result, though Democrats will not, likely, be able to propose and enact legislation, they should be able to block bills and, as a result, may in some instances be asked to cooperate on a bipartisan basis with GOP-led initiatives. A divided government will probably slow down or halt GOP-sponsored legislation on a number of fronts, including further tax cuts, immigration reform and ACA repeal. However, it may also open to the door to compromise on shared priorities, possibly infrastructure or DACA status.

For financial markets, that means that investors can probably not expect further tax-reform driven stimulus but slowing down the pace of change may create some additional stability. And, as David Kelly, the global chief strategist for JPMorgan Asset Management notes, divided government has historically been the norm, rather than the exception. “If you go back to 1945, the U.S. has had divided government 61% of the time. So that is kind of the norm. I don’t expect that we will see dramatic policy change if the democrats take the House,” says Kelly.

“I don’t think divided government is necessarily bad,” Kelly adds. “For example, a single-party republican government might cut taxes more, but the problem is that the country doesn’t need and can’t afford further tax cuts. Similarly, a single-party democratic government might make health care available for all and while that might be a laudable goal, if it’s not paid for or it’s paid for by raising corporate taxes that could have a negative impact. Sometimes it is dangerous for the economy when a single party gets to do whatever they want to do, particularly when the parties are so polarized as they are today.”

Wells Fargo’s Holke concurs that divided government will reinforce the status quo. “We don’t see any likelihood of any significant policy accomplishment, legislative accomplishment in a divided government, so nothing that would seriously drive markets one way or another which should hopefully allow everyone to return to focusing on fundamentals,” he says. “We still have growth in the U.S. and the best labor market in decades. Once this election is over and the uncertainty is removed, we hope markets will get back to doing what they do best.”

A strong economy, but an aging bull market

With the midterms settled, markets will again be driven primarily by economic factors – a strong economy on the positive side, but rising interest rates, trade tensions and an aging bull market on the other.

During the midterms President Trump proposed an additional 10% middle class tax cut, which would likely have been positive for the markets. Now, most experts believe that is off the table. But Holke cautions that, with a presidential election just two years away, contenders on both sides of the aisle will be looking for wins. “Definitely all of the politicians getting ready for the next presidential election would like to enact legislation that stimulates growth,” he says. “So, where that would come from, what the likelihood is, how that would be paid for, depends on who comes out of the election with power.”

Most of the experts also believed that trade tensions would resolve fairly soon. “I think there will be increasing pressure on the president to make a deal with China, because while people like the idea of standing tough against China, when it actually involves both higher prices for basic consumer goods, I think that’s going to cause a lot of push back from both the small businesses and consumers,” says Kelly. “Also, a tariff war is very damaging to the global economy and if the economy is slowing down, the president will want to make sure he’s got a healthy economy for 2020.”

“But apart from that, I think it’s really important for investors and advisors to not worry so much about politics, but think about where we are,” Kelly continues. “We are in the 10th year of a bull market. The 10th year of an economic expansion. Regardless of your political views, the movement in asset prices suggests that you need to be more balanced. Stocks are not as cheap as they were, and bonds are not as expensive as they were. Either way this election goes, I expect that the Federal Reserve will continue to raise rates at least through June of next year. And that suggests that people should be more level between stocks and bonds.”

Kelly also suggests that advisors and their clients take a look at their allocations across global markets now. “The 2016 election meant that the U.S. did significant fiscal stimulus at a time when nobody else was doing this. That has sped up the U.S. economy relative to the rest of the world, but the U.S. economy is going to come off its sugar high in 2019, while the rest of the world should maintain a strong pace.”

Most investors should stick to their plans

In the end, after the excitement has faded, perhaps the best course for advisors and their clients is to do what they’ve always done: invest to meet long-term goals.

“Markets inevitably go up and down. That’s normal. And if an investor has a plan and has a strategy, they can more easily deal with the ups and downs when they do occur, regardless of what the headlines are at that moment. There’s always something going on in the headlines,” says Dechtman.