On March 27, the President signed into law the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which is aimed at providing financial relief for the economic downturn caused by the Coronavirus pandemic. This commentary covers some of the more pertinent issues to small businesses and individuals.

Individual Charity-Related Provisions

![]()

The CARES Act allows for an above-the-line deduction up to $300 for cash contributions to certain charities for those who do not itemize deductions. Also, the Act increases the limitations on deductions for “qualified contributions” by individuals who itemize by suspending the 50% of AGI limitation, meaning up to 100% of AGI may be claimed as a charitable itemized income tax deduction. A “qualified contribution” is a contribution paid in cash during calendar year 2020 to an organization described in section 170(b)(1)(A) and the taxpayer has elected the application of this section with respect to such contribution. A “qualified contribution” does not include a contribution to an organization described in section 509(a)(3) or to a donor advised fund.

Student Loan Provisions

The Act suspends student loan payments (principal and interest) through September 30, 2020 without penalty to the borrower for federal student loans. No interest will accrue on these loans during this suspension period.

In addition, employers may provide a student loan repayment benefit to employees on a tax-free basis. Under the provision, an employer may contribute up to $5,250 annually toward an employee’s student loans, and such payment would be excluded from the employee’s income. The $5,250 cap applies to both the new student loan repayment benefit as well as other educational assistance (e.g., tuition, fees, books) provided by the employer under current law. The provision applies to any student loan payments made by an employer on behalf of an employee after date of enactment and before January 1, 2021.

Assistance for American Workers, Families, and Businesses

All U.S. residents with adjusted gross income up to $75,000 ($150,000 married), who are not a dependent of another taxpayer and have a work eligible social security number, are eligible for a full $1,200 “rebate,” $2,400 married. In addition, they are eligible for an additional $500 per child. This is true even for those who have no income, as well as those whose income comes entirely from non-taxable means-tested benefit programs, such as SSI benefits. Estates and trusts are not eligible for this rebate. The rebates are being treated as advance refunds of a 2020 tax credit and taxpayers will reduce the amount of the credit available on their 2020 tax return by the amount of the advance refund payment they receive.

For the vast majority of Americans, no action on their part will be required in order to receive a rebate check as the IRS will use a taxpayer’s 2019 tax return if filed, or in the alternative their 2018 return. This includes many low-income individuals who file a tax return in order to take advantage of the refundable Earned Income Tax Credit and Child Tax Credit.

The rebate amount is reduced by $5 for each $100 that a taxpayer’s income exceeds the phase-out threshold. The amount is completely phased-out for single filers with incomes exceeding $99,000, $146,500 for head of household filers with one child, and $198,000 for joint filers with no children.

These payments are expected to be made electronically if possible. However, the Act states that “Not later than 15 days after the date on which the Secretary distributed any payment to an eligible taxpayer, notice shall be sent by mail to such taxpayer’s last known address. Such notice shall indicate the method by which such payment was made, the amount of such payment, and a phone number for the appropriate point of contact at the Internal Revenue Service to report any failure to receive such payment.”

Unemployment Insurance Provisions

The Act creates a temporary Pandemic Unemployment Assistance program through December 31, 2020 to provide payment to “covered individuals” who are not traditionally eligible for unemployment benefits, such as self-employed individuals, independent contractors, and those who have limited work history because they were unable to work as a direct result of the coronavirus public health emergency. “Covered individuals” include those who are not eligible for regular unemployment benefits and provide self-certification that the individual is otherwise able to work but for:

-

being diagnosed with COVID-19

-

a member of the individual’s household has been diagnosed with COVID-19

-

the individual is providing care for a family member diagnosed with COVID-19

-

a child is unable to attend school because it is closed due to COVID-19

-

the individual is unable to get to work because of quarantine order or is self-quarantined based on health care provided advice

-

the individual quit his job as a direct result of COVID-19

-

the individual’s job is closed as a direct result of COVID-19, or

-

is self-employed, is seeking part-time employment, does not have sufficient work history, or otherwise would not qualify for regular unemployment or extended benefits under State or Federal law or pandemic emergency unemployment compensation.

“Covered individuals” do not include individuals who have the ability to telework with pay (i.e., work from home) or who are receiving paid sick leave or other paid leave benefits. A person may receive benefits under the Pandemic Unemployment Assistance program for up to 39 weeks, which includes any week the person received regular pay or extended benefits under any federal or state program.

The Act also provides an additional $600 per week to each recipient of unemployment insurance or Pandemic Unemployment Assistance for up to four months. There will also be an additional 13 weeks of unemployment benefits through December 31, 2020 to help those who remain unemployed after state unemployment benefits are no longer available.

Business Tax Relief Provisions

Charitable Contributions by Corporations: Contributions cannot exceed the excess of 25% of the business’ taxable income, which was increased from 10% under prior law.

Employee Retention Credit: The bill creates a refundable payroll tax credit for 50 percent of wages paid by employers to employees during the COVID-19 crisis. The credit is available to employers whose (1) operations were fully or partially suspended, due to a COVID-19-related shut-down order, or (2) gross receipts declined by more than 50 percent when compared to the same quarter in the prior year.

The credit is based on qualified wages paid to the employee. For employers with greater than 100 full-time employees, qualified wages are wages paid to employees when they are not providing services due to the COVID-19-related circumstances described above. For eligible employers with 100 or fewer full-time employees, all employee wages qualify for the credit, whether the employer is open for business or subject to a shut-down order. The credit is provided for the first $10,000 of compensation, including health benefits, paid to an eligible employee. The credit is provided for wages paid or incurred from March 13, 2020 through December 31, 2020.

Delay of Employer Payroll Taxes: Employers generally are responsible for paying a 6.2-percent Social Security tax on employee wages, and the bill allows employers and self-employed individuals to defer payment of the employer share of the Social Security tax they otherwise are responsible for paying to the federal government with respect to their employees. The provision requires that the deferred employment tax be paid over the following two years, with half of the amount required to be paid by December 31, 2021 and the other half by December 31, 2022.

Temporary Increase in Business Interest Deduction: The bill temporarily increases the amount of interest expense businesses are allowed to deduct on their tax returns, by increasing the 30-percent limitation to 50 percent of taxable income (with adjustments) for 2019 and 2020.

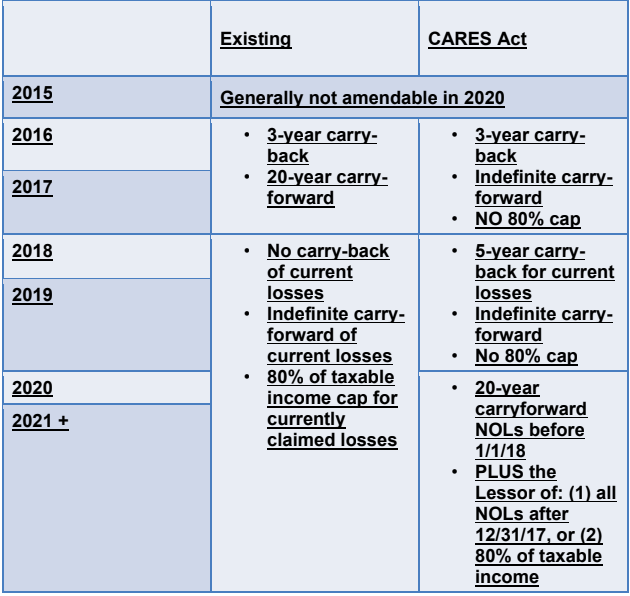

Treatment of NOLs: The Tax Cuts and Jobs Act of 2017 significantly pared back the ability of businesses to carry forward/carry back Net Operating Losses. This was widely criticized at the time by some experts because NOLs had traditionally been used as a tool to provide tax relief when a business loses money.

Prior to the implementation of the Tax Cuts and Jobs Act, the Service allowed businesses to carry net operating losses (NOL) forward 20 years to net against future profits or backwards two years for an immediate refund of previous taxes paid. The Tax Cuts and Jobs Act eliminated the two-year net operating loss (NOL) carryback provision and allowed for an indefinite NOL carryforward period. The CARES Act substantially liberalizes the NOL rules as set out in the chart below:

Retirement Plan Provisions

IRA Contribution Deadline

The deadline for filing an individual’s 2019 income tax return is extended to July 15, 2020. In an FAQ, the IRS stated “Contributions can be made to your IRA, for a particular year, at any time during the year or by the due date for filing your return for that year. Because the due date for filing Federal income tax returns has been postponed to July 15, the deadline for making contributions to your IRA for 2019 is also extended to July 15, 2020.”

Withdrawals from Qualified Retirement Plans and IRAs, and Plan Loans

The CARES Act provides tax relief for retirement plan and IRA “coronavirus-related distributions” up to $100,000 taken by individuals on or after January 1, 2020 and before December 31, 2020. The CARES Act permits in-service distributions, provides an exception to the 10% early distribution penalty, exempts the distribution from the mandatory 20% withholding applicable to eligible rollover distributions, allows the individual to include income attributable to the distribution over a three-year period, and allows the for the recontribution of the distribution to a plan or IRA within three years.

The CARES Act provides that for plan loans made during the 180-day period beginning on the date of enactment and December 31, 2020 the maximum loan amount is increased from $50,000 or 50% of the vested account balance to $100,000 or 100% of the vested account balance. The due date for any repayment on a loan is delayed for one year (normally five years).

To be eligible for the withdrawal and loan relief, an individual must fall within one of the following categories:

-

• The individual is diagnosed with COVID-19 by a test approved by the Centers for Disease Control and Prevention;

-

• The individual’s spouse or dependent is diagnosed with COVID-19; or

-

• The individual experiences adverse financial consequences as a result of being quarantined, being furloughed or laid off or having work hours reduced due to COVID-19, being unable to work due to lack of child care due to COVID-19, closing or reducing hours of a business owned or operated by the individual due to COVID-19, or other factors as determined by the Secretary of the Treasury.

Plan administrators may rely on an employee’s certification that the employee meets these requirements.

RMDs

The CARES Act suspends RMDs for 2020.

Keeping American Workers Employed and Paid Act

One of the important cornerstones of the CARES Act is what is described in the bill as the “Paycheck Protection Program.” Congress understands that the majority of jobs in the American economy are generated by small to mid-size businesses, and the CARES Act seeks to shore up payroll in those businesses by leveraging the Small Business Administration’s Section 7(a) loan program because it’s the primary program for providing financial assistance to small businesses.

The CARES Act increases the maximum 7(a) loan amount to $10 million and expands the allowable uses of 7(a) loans to include “payroll support,” which includes paid sick or medical leave, employee salaries, mortgage payments, insurance premiums and any other debt obligations.

Under the CARES Act, the loan period for this program starts on February 15, 2020, and ends on June 30, 2020. The program generally only covers businesses with fewer than 500 employees.

To determine whether a business is eligible for this program, the CARES Act require lenders to ascertain: (1) whether a business was operational on February 15, 2020, and (2) whether the business had employees to whom it paid salaries and payroll taxes, or paid independent contractors, and (3) whether the business was substantially impacted by COVID-19. The legislation also gives more authority to lenders regarding eligibility determinations without having to run those determinations through the normal SBA approval channels.

Business eligible for the expanded 7(a) loans under the CARES Act include small businesses, nonprofits and veterans organizations with 500 or fewer employees. During the covered period, individuals who operate under a sole proprietorship or as an independent contractor and eligible self-employed individuals shall be eligible to receive a covered loan.

The CARES Act says that the allowable uses of 7(a) loans include salary, wages, commissions, tips, paid leave, healthcare payments and retirement benefit payments. It’s important to note that allowable payroll costs do not include compensation to an individual employee in excess of an annual salary of $100,000 as prorated for the covered period. Qualified sick leave

or family leave wages for which a credit is allowed under the Families First Coronavirus Response Act are not included in the allowable uses. It also does not include any compensation of an employee whose principal place of residence is outside of the United States.

One of the most important aspects of the CARES Act is that the 7(a) loans are nonrecourse, except if the proceeds are used for an unauthorized purpose. In addition, no personal guarantee or collateral are required. That said, “Good Faith” certification is required and certification has the following elements:

• The current uncertainty makes the loan necessary to support ongoing operations;

• The funds will be used to retain works and maintain payroll or make mortgage payments, lease payments, and utility payments;

• There are no duplicative amounts.

The terms of these loans are as follows:

• Interest Rate: During the covered period, a covered loan shall bear an interest rate not to exceed 4 percent

• Payment Deferment: 6-12 month of deferment including principal, interest and fees

• Origination Fees: Lender reimbursed by the SBA

One of the most important aspects of the program is the way in which loan principal can be forgiven. Under the terms of the legislation, principal can be forgiven in an amount equal to the following costs incurred during the covered period of February 15, 2020 through June 30, 2020:

• Payroll costs

• Mortgage interest

• Rent

• Utilities

Any amounts forgiven will be reduced proportionally by any reduction in the number of employees retained compared to the prior year and reduced by the reduction in pay of any employee beyond 25 percent of their prior year compensation. Borrowers that re-hire workers previously laid off will not be penalized for having a reduced payroll at the beginning of the period. Most importantly, indebtedness cancelled will not be included in the borrower’s taxable income.

CREDIT FOR THIS COMMENTARY:

Robert Keebler, Michael Geeraerts and Jim Magner provide LISI members with commentary on the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Members who would like to learn more about this topic should consider joining Bob Keebler in his exclusive LISI Webinar @ 5:00pm ET today titled “Stimulus and Tax Bill (CARES) Creates Immediate Planning Opportunities: What Advisors Must Know Now to Help Clients Protect/Save their Business.” For more information and to register, click this link: Bob Keebler

Robert S. Keebler, CPA/PFS, MST, AEP (Distinguished) is a partner with Keebler & Associates, LLP and is a 2007 recipient of the prestigious Accredited Estate Planners (Distinguished) award from the National Association of Estate Planners & Councils. He has been named by CPA Magazine as one of the Top 100 Most Influential Practitioners in the United States and one of the Top 40 Tax Advisors to Know During a Recession. Mr. Keebler is the past Editor-in-Chief of CCH's magazine, Journal of Retirement Planning, and a member of CCH's Financial and Estate Planning Advisory Board. His practice includes family wealth transfer and preservation planning, charitable giving, retirement distribution planning, and estate administration. Mr. Keebler frequently represents clients before the National Office of the Internal Revenue Service (IRS) in the private letter ruling process and in estate, gift and income tax examinations and appeals. In the past 20 years, he has received over 250 favorable private letter rulings including several key rulings of first impression. Mr. Keebler is nationally recognized as an expert in estate and retirement planning and works collaboratively with other experts on academic reviews and papers, and client matters. Mr. Keebler is the author of over 75 articles and columns and editor, author, or co-author of many books and treatises on wealth transfer and taxation, including the Warren, Gorham & Lamont of RIA treatise Esperti, Peterson and Keebler/Irrevocable Trusts: Analysis with Forms. Mr. Keebler is the Chair of the AICPA's Advanced Estate Planning Conference. He is a featured columnist for CCH's Taxes Magazine - Family Tax Planning Forum, Bob is also a contributing author to the American Bar Association's The ABA Practical Guide to Estate Planning.

Michael Geeraerts, CPA, JD, CGMA®, CLU® is an advanced planning consultant at The Guardian Life Insurance Company of America. Prior to joining Guardian, Michael was a manager at PricewaterhouseCoopers LLP and a tax consultant at KPMG LLP. Michael’s experiences range from preparing tax returns for middle market companies, auditing mutual funds’ financial statements, to researching unique tax savings strategies for various companies. Michael has written articles for numerous national publications and has delivered continuing education courses to CPAs and attorneys on a variety of estate, business and income tax planning strategies.

Jim Magner is an advanced planning attorney at The Guardian Life Insurance Company of America.i Jim previously worked as an Attorney Advisor in the IRS’s Office of Chief Counsel in Washington, DC where he wrote private and public rulings on estate, gift, GST and charitable remainder trust issues.

Republished with permission by:

LISI Income Tax Planning Newsletter #194 (March 27, 2020) at http://www.leimbergservices.com, Copyright 2019 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited - Without Express Permission. This newsletter is designed to provide accurate and authoritative information in regard to the subject matter covered. It is provided with the understanding that LISI is not engaged in rendering legal, accounting, or other professional advice or services. If such advice is required, the services of a competent professional should be sought. Statements of fact or opinion are the responsibility of the authors and do not represent an opinion on the part of the officers or staff of LISI.