Last week over 700 advisors and asset managers alike took time out of their busy schedule to hear from 7 industry leaders from big-name firms including BlackRock, Envestnet, Morningstar, Orion, AssetMark and SMArtX on what’s transforming model portfolios into a new investment craze. Part 1 of 4.

For many, model portfolios and TAMPs are not new, so what was the main attraction? The program’s spotlight went to BlackRock, which recently became part of America’s Best TAMPs 2021 as a model portfolio strategist.

Behind the curtain, few have yet to really appreciate the speed with which BlackRock has emerged a lead player in the models space, delivering free investment advice via model marketplaces and TAMPs . . . a $2 trillion sandbox for RIAs and BDs looking for more than blunt instruments to fill their clients' portfolios.

BlackRock is now at $60B in the models arena and this end of the business has been doubling every year in AUM terms over the past five years, according to TAMP Summit presenter Eve Cout, a director at the firm who called in from Scotland to attend the event.

The giant is not shy about the allure of competing in such a dynamic area of the overall market, as more than 50% of its ETF sales is attributed to model portfolios -- and that success has served an inspirational beacon, part promise and part threat, to other asset managers who create and distribute model portfolios.

Scott Martin kicked off the meeting offering a memorable comparison of models to music:

“For advisors, an ETF is only one tool in a box – a single instrument playing a simple tune. A model portfolio is like a Philharmonic orchestra performing with hundreds of instruments producing a crescendo of sounds under the baton of an expert conductor."

Martin moved from music to an audience poll that revealed that 48% of guests were model portfolio creators and distributors. That made it clear they were there to learn from BlackRock.

FIVE EASY PIECES

Eve Cout made the secret to success extremely clear. “We want to be easy to use, easy to customize, easy to buy, easy to rebalance, easy to lower taxes and easy to explain” she told attendees.

“We've found as we've worked with financial advisors, that almost 80% of advisors will consolidate more of their book with one or two providers. So these are strategic deep relationships. You're going to be a book-wide solution, and that's why it's really important for us to think about how easy, convenient, and also frictionless we can make access in a BlackRock model.”

YOU DON’T SET AND FORGET THE STEERING WHEEL

BlackRock’s second lesson of success is about the steering wheel.

“We all like Uber, but would we get into an Uber driverless car? Probably not. We like the innovation, but we still want to know someone's at the wheel, and it's really important with model portfolios that you have a portfolio manager. You have your investment processes. There's someone on the wheel, regardless of what's going on in the markets, who can make reactive decisions on those portfolios," Cout told the audience.

"This isn't about trading every day or every month, this is just about having the reaction to major market events. They'll enter the process with a portfolio manager looking at the portfolio every day. We don't trade monthly. It's too much activity for our advisors, too much for clients to keep on top of. We have found the right balance to be four to six times a year. That's where you're getting the right tactical tilts in the portfolio, but you're not also overwhelming the advisor with too many trades or too many things to keep up with as they look to share that with the client.”

MANY DIFFERENT FLAVORS

Dana D’Auria, Co-CIO of Envestnet, offered clarity on the models as well.

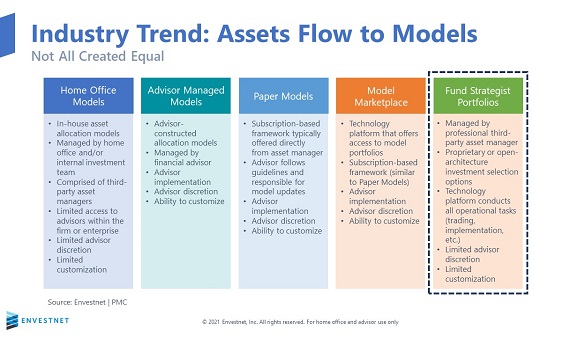

"So what do we mean when we talk about models? The majority of the folks on the call today are managing their own models. Envestnet obviously has a robust system for that in our advisor as portfolio manager system," she told the audience.

"Then we have ways to deliver the models: what we call fund strategist portfolios, which is your broadly distributed third-party asset manager models, and those can be a separate asset manager or proprietary," she continued.

"We heard a lot today about different types of models in terms of how the fund manager can be the model manager, delivering the model with no overlay costs. There are also, of course, many model managers who do have an overlay cost and they're completely open architecture and providing the asset allocation and rebalancing, etc.”

And these were only a few of the insights discussed last week. We'll keep mining the transcript for more in the near future.

Part 1 of 4 The 2021 TAMP and Model Portfolio Summit highlights.

Next week: Models vs. Marketplaces: Insights from Evan Rapoport, CEO SMArtX and Eric Clarke, CEO Orion.