In late March, the federal government passed the CARES Act in response to the coronavirus crisis. As part of this new legislation, individual workers, independent contractors, gig workers, and freelancers are immediately entitled to receive a onetime $1,200 payment ($2,400 for married couples) from the IRS, plus an additional $500 per dependent 16 years or younger.

In order to qualify for the full amount, you have to have earned $75,000 or less in the prior year ($150,000 or less if married). Above those income levels, the stimulus payment decreases until it stops altogether for single people earning $99,000 or married couples who have no children and earn $198,000. If you haven’t prepared your 2019 tax return, you can use your 2018 return to see if you meet the required income level.

How can you make sure you get this stimulus payment quickly if you do qualify? The key is for the IRS to have the direct deposit account information for your bank account. Otherwise the payment will be sent by mail and could be delayed for several months.

Direct deposit information

The direct deposit information is as follows:

- The name of your bank

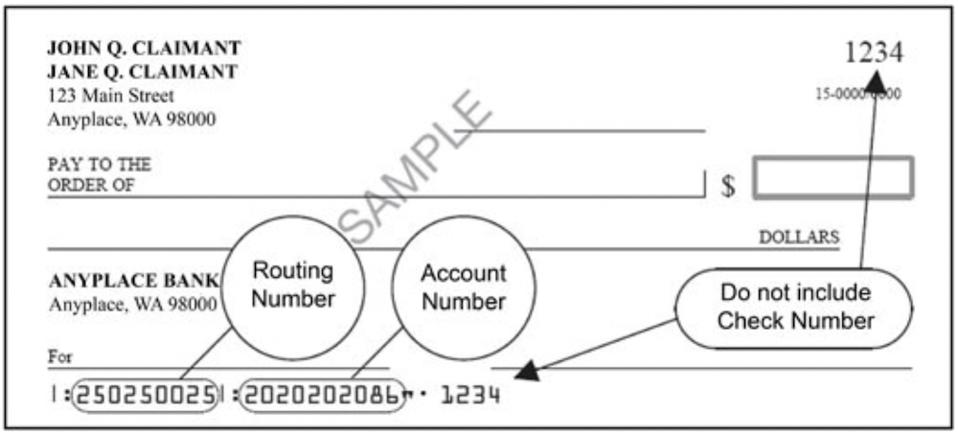

- Your bank account number, which can be up to 17 characters (see image below). On the sample check below, the account number is 2020202086.

- The “routing number” for your bank, which must contain 9 digits (see image below). On the sample check below, the routing number is 250250025.

- Don’t include the check number (1234 on the image below).

How do you provide this direct deposit information to the IRS? The following guidance depends on your particular situation.

If you have filed your 2018 or 2019 tax return with the correct deposit information

If you have already filed your 2018 or 2019 tax return with the IRS with your correct direct deposit information, you don’t need to do anything more.

If you haven’t filed your 2018 or 2019 tax return

If you haven’t filed your 2018 or 2019 tax return with the IRS, you need to file either one electronically with the IRS (unless you are exempted as a social security benefits recipient as discussed below). There are some free websites that allow you to file your return electronically. See the sites recommended by the IRS at www.irs.gov/filing/free-file-do-your-federal-taxes-for-free. Make sure to include your direct deposit information in this filing (where it asks if you want any refund sent by direct deposit).

What to do if the IRS doesn’t have your current direct deposit information

The Treasury is expected to shortly announce an online portal where direct deposit information can be supplied to the IRS. Here is what you should do:

- Go to http://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know to see if they have set up the online portal. (This article will be updated with the web address once it’s available.)

- Add the bank account number of your account.

- Add the routing number of your bank.

- Don’t include the check number.

- Double-check that you have entered the correct numbers. Entering an incorrect number could result in a 4-6 week delay of payment.

Social Security recipients

On April 1, 2020, the Treasury announced that Social Security recipients who are not typically required to file a tax return will automatically receive their payment directly to their bank account, without having to file a tax return, so long as the IRS has your direct deposit information.

Will you have to pay any income tax on the stimulus payment received?

You will not have to pay income tax on the amount of payment received.

What IRS resources are available for more information?

Check these links for updated information:

- irs.gov

- https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

- http://www.irs.gov/coronavirus

This article originally appeared on Forbes.